TSMC Smashes Profit Records as AI Demand Sparks U.S. Factory Expansion

Here’s a rewritten, simple, engaging, and SEO-friendly version of your TSMC article, structured with H2 and H3 headings, natural flow, and clickbait-style options:

TSMC Shatters Profit Records, Eyes More U.S. Factories Amid AI Boom

TSMC, the world’s leading producer of advanced AI chips, has reported record-breaking profits, beating forecasts by a wide margin. Riding the wave of artificial intelligence demand, the Taiwanese semiconductor giant also announced plans to expand its manufacturing footprint in the United States, signaling strong growth ahead.

Record-Breaking Profit and Revenue

For the fourth quarter of 2025, TSMC posted a net profit of T$505.7 billion ($16 billion), marking a 35% increase compared to the previous year. This is the company’s seventh consecutive quarter of double-digit growth, significantly surpassing the T$478.4 billion forecast by LSEG SmartEstimate.

Looking ahead, TSMC expects revenue in the first quarter of 2026 to surge as much as 40% year-on-year, potentially reaching $35.8 billion. Analysts see these results as a strong start to the tech earnings season, highlighting TSMC’s pivotal role in the AI and semiconductor markets.

AI Mega Trend Driving Demand

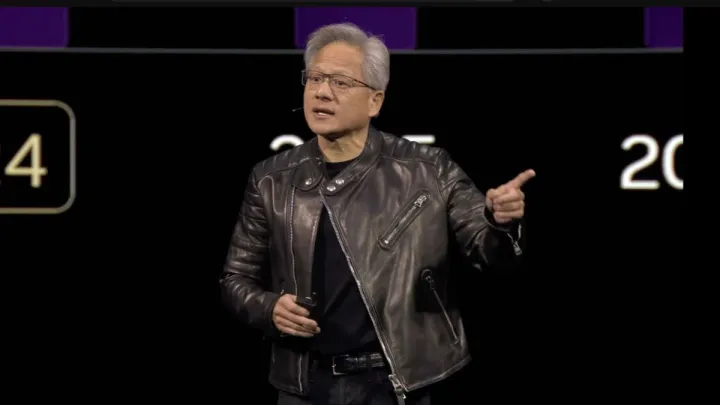

TSMC credits much of its success to the “AI mega trend.” Customers, including major tech giants like Nvidia and Apple, have been requesting more capacity to meet growing demand. The company projects that 2026 revenue could rise nearly 30% in U.S. dollar terms, fueled by continued AI investment worldwide.

Ben Barringer, head of technology research at Quilter Cheviot, said, “While the likes of Nvidia, Broadcom, and AMD compete for chip supremacy, TSMC ultimately benefits as the key manufacturer of all their chips.”

Expanding U.S. Operations

TSMC is accelerating capacity expansion both in Taiwan and the United States. In Arizona, the company is seeking permits to build a fourth factory and its first advanced packaging plant. Additional land has already been purchased for future facilities, forming what CEO C.C. Wei described as a “gigafab cluster” to improve productivity and reduce costs while serving U.S. customers more efficiently.

U.S. Secretary of Commerce Howard Lutnick confirmed that TSMC plans to invest more in the country. Reports suggest that a trade deal with Taiwan could lower tariffs from 20% to 15%, potentially encouraging TSMC to commit to at least five more factories in Arizona.

Capital Spending and Caution

TSMC expects capital expenditures to rise as much as 37% in 2026, reaching $56 billion. Spending will increase further in 2028 and 2029 to keep up with AI demand. Despite the optimism, CEO Wei emphasized caution, warning that overspending without careful planning could create significant risks for the company.

“We’re also very nervous about it,” Wei said. “If we did not invest carefully, that would be a disaster for TSMC for sure.”

Market Impact

TSMC’s market capitalization now sits at around $1.4 trillion, making it more than twice the value of Samsung Electronics. The company’s Taipei-listed shares jumped 44% in 2025, outperforming the broader market, and are already up about 9% so far in 2026.

As AI continues to drive global semiconductor demand, TSMC is positioning itself as the indispensable manufacturer for the world’s leading chipmakers, solidifying its dominance in the industry.