TSMC Reports 34% Sales Growth in November, Fueled by Booming AI Demand

TSMC reports 34% sales growth in November, fueled by demand for AI chips. With its leading role in AI hardware, the chipmaker is poised for continued success in the semiconductor market.

In November 2024, Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, posted a robust 34% year-on-year sales growth, driven largely by sustained demand for chips powering artificial intelligence (AI) technologies. The company, known for producing critical semiconductors for tech giants like Apple and Nvidia, generated NT$276.1 billion ($8.5 billion) in sales, further solidifying its leadership in the semiconductor sector.

AI Demand Drives TSMC’s Impressive Sales Surge

TSMC's sales momentum is largely attributed to the boom in AI-driven hardware demand. As AI technologies like ChatGPT and advanced machine learning models continue to grow, so does the need for specialized semiconductor chips to power the massive computing infrastructure behind them. These chips are essential for AI data centers, which are seeing a surge in investment from major tech players like Microsoft and Amazon.

Between October and November, TSMC’s combined sales rose by an impressive 31.4%, with analysts forecasting a 36.3% growth for the current quarter. This strong performance comes as AI has emerged as a key driver of chip demand, spurring the company’s rapid growth in the second half of 2024.

TSMC’s Position as an AI Bellwether

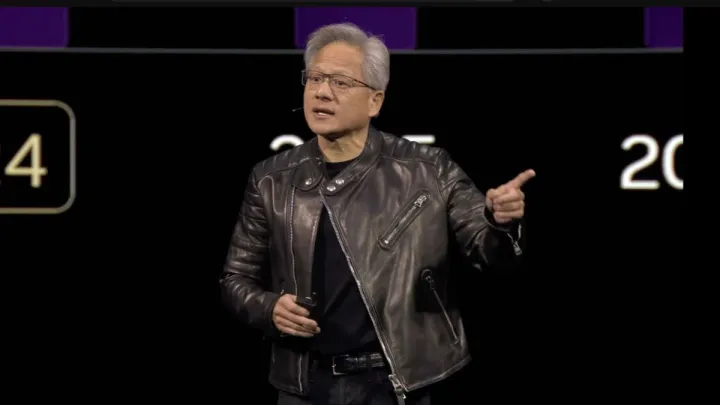

As the go-to chip supplier for leading AI hardware players such as Nvidia, TSMC is viewed as a barometer for the future of AI computing infrastructure. The company’s success is closely tied to the rise of AI, which continues to reshape industries from cloud computing to autonomous driving. Given TSMC’s market dominance and expertise in manufacturing cutting-edge chips, it is poised to play a significant role in powering the AI revolution.

Strong Performance Amid Competitor Struggles

Despite the positive growth, TSMC's competitors, such as Samsung Electronics and Intel, are facing challenges in securing major customers. This could give TSMC a potential edge in terms of pricing power in the coming months. Analysts, including Bloomberg Intelligence’s Charles Shum, predict that TSMC’s strong position in the AI space could allow it to increase its chip prices, benefiting from its unshakable foothold in the industry.

While TSMC is reaping the benefits of AI’s expansion, it is also keeping a close eye on the evolving market dynamics. The rapid build-out of AI data centers, driven by enormous investment from big tech firms, presents both opportunities and risks. There is growing concern in the investment community about whether this huge spending surge will ultimately pay off, especially given the lack of a definitive “killer app” for AI that would spur further growth in data-center demand.

Challenges and Uncertainty in the AI Boom

Despite the robust growth, some investors are beginning to question the sustainability of the current AI-driven spending boom. While AI is undoubtedly changing industries, there is still a degree of uncertainty surrounding its commercial applications. The tech sector is waiting for more breakthrough AI technologies that could transform markets and justify the billions being invested in AI infrastructure.

Analysts remain cautious, noting that while AI hardware demand is high, there is no guarantee that the returns on these investments will match the expectations of the companies making them. This uncertainty could create volatility in the stock prices of both AI hardware manufacturers and companies building data centers.

TSMC Shares Surge as AI Demand Outpaces Rivals

Despite these concerns, TSMC's stock price has surged by nearly 80% this year, reflecting investor confidence in the company’s position at the center of the AI and semiconductor boom. With a steady flow of demand from major companies like Nvidia, Apple, and other AI players, TSMC is set to continue its dominance in the chip market as AI adoption spreads across industries.

However, as TSMC enjoys the fruits of its AI success, the future remains dependent on the continued growth of AI applications and the broader digital infrastructure that supports them. The company’s ability to capitalize on its market position in the face of competition and fluctuating market conditions will be key to its future growth.

Looking Ahead: TSMC’s Role in Shaping AI’s Future

Looking ahead, TSMC’s role in the AI ecosystem will likely continue to be a critical one. As AI evolves, so too will the semiconductor requirements of the industry. TSMC is well-positioned to be at the heart of this transformation, thanks to its cutting-edge technology and strong relationships with major players in the tech world.

However, the company must also navigate potential risks associated with over-reliance on AI-driven growth. The tech industry’s volatile nature means that TSMC will need to keep adapting and innovating to stay ahead of the curve.