Trump’s T1 Smartphone Likely to Be Made in China

Experts say Donald Trump’s T1 mobile phone will likely be made in China, raising questions about U.S. manufacturing claims and political consistency.

Despite political rhetoric on U.S. manufacturing, analysts predict Donald Trump's upcoming T1 phone will rely on Chinese production to compete on cost and scale.

Donald Trump’s T1 Mobile Phone Expected to Be Manufactured in China, Raising Questions on U.S. Industry Goals

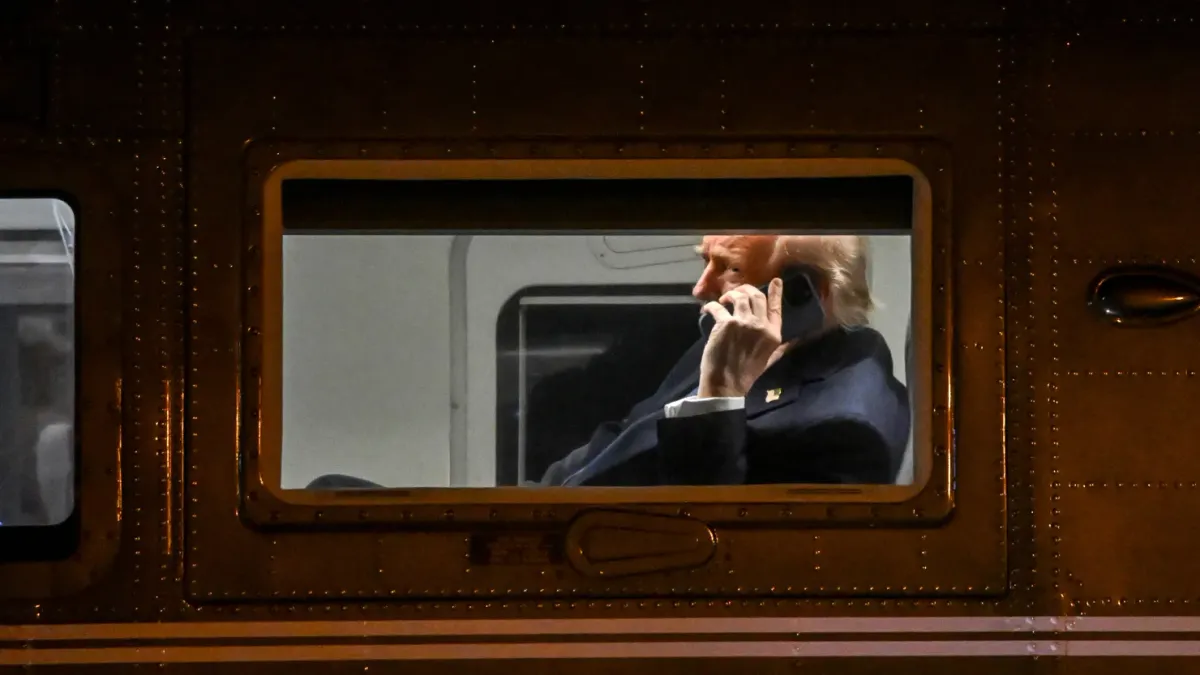

Former President Donald Trump’s much-anticipated T1 mobile phone is likely to be produced in China, according to experts cited in a CNBC report published June 17. This development draws scrutiny, given Trump’s outspoken advocacy for American manufacturing and previous efforts to encourage U.S. tech companies to return production stateside.

Trump’s Entry into the Mobile Market

Trump Media & Technology Group (TMTG), the company behind Truth Social, announced earlier this year its foray into the mobile device sector. The T1 phone is pitched as a privacy-focused, conservative alternative to major brands like Apple and Samsung, aiming to attract users dissatisfied with the current market leaders.

Details about the T1’s features and design remain limited. However, TMTG has positioned the device as “Made in America” in spirit, if not in practice, citing the need for secure, independent platforms for communications and media.

Expert Analysis: “Made in America” Far from Reality

Despite TMTG’s marketing, industry experts believe that manufacturing the T1 phone entirely in the United States is not economically or logistically feasible at this time. Most smartphones—including those from Apple and Samsung—are assembled in Asia, primarily China, where established supply chains and lower production costs dominate the industry.

“Making a phone from scratch in the U.S. would be incredibly expensive and slow,” said Patrick Moorhead, CEO of tech analysis firm Moor Insights & Strategy, in the CNBC report. “There’s a reason even Apple, which has significant resources, still relies on China for assembly. Tooling, labor, component sourcing—China remains the center of the global smartphone industry.”

A senior unnamed supply chain manager told CNBC, “Unless TMTG is ready to spend billions and wait several years, the T1 will inevitably be made in China or possibly co-assembled in countries like Vietnam or India.”

Political Contradictions and Market Strategy

Trump has made reinvigorating American manufacturing a central part of his political platform, repeatedly chiding companies that outsource production overseas. His administration famously pressed Apple to consider more domestic assembly for the iPhone, with limited results.

The T1’s likely reliance on China undercuts Trump’s messaging and opens him to charges of hypocrisy, especially as he continues to campaign on “America First” economic policies.

“Consumers will notice the contradiction,” said Thomas Hayes, chairman of Great Hill Capital. “But the reality is you can’t launch a competitive mass-market phone without China’s manufacturing engine.”

Others suggest Trump’s base may overlook the sourcing issue if the phone delivers on promised privacy features and political alignment. “His supporters want a safe, anti-censorship device,” said technology consultant Sarah Carter. “For them, where it’s made is secondary—at least at launch.”

Supply Chain, Costs, and Competitive Pressures

Manufacturing in the U.S. comes with significant hurdles: the absence of a robust supply chain for electronic components, higher labor costs, and a lack of specialized infrastructure for mass assembly. Smartphone prices could soar if American factories replace Chinese ones; a recent Boston Consulting Group report estimates that producing an iPhone entirely in the U.S. would increase the retail price by at least 20%.

Chuck Robbins, CEO of Cisco, commented at a recent industry panel, “Reshoring electronics manufacturing is a great goal, but unrealistic for consumer devices unless the U.S. invests heavily in supply chains and talent.”

Secondary keywords: T1 smartphone, U.S. manufacturing, China supply chain, Trump mobile phone, Truth Social

Geopolitical Implications

TMTG’s apparent dependence on Chinese production has drawn attention amid growing U.S.-China tensions. Washington continues to restrict exports of advanced U.S. semiconductors to China, and both countries have imposed tariffs on a range of technology goods.

The T1’s rollout will be closely watched as yet another measure of the complex entanglements between U.S. branding and global supply chains.

As the Trump T1 mobile phone edges closer to launch, expert consensus is clear: the device will most likely be sourced from Chinese or adjacent Asian factories, despite branding that suggests American independence. The tension between political messaging and market realities serves as a microcosm of broader challenges facing the U.S. tech industry.

The success of the T1 will ultimately depend on consumer priorities—whether a phone’s origin matters more than what it promises to deliver.

Sources Used:

CNBC: Trump T1 mobile phone will likely be made in China, experts say

Boston Consulting Group, “The Economics of Smartphone Supply Chains,” 2023

U.S. Department of Commerce data on tech manufacturing

Public statements from Patrick Moorhead, Moor Insights & Strategy

Industry panel comments from Chuck Robbins, Cisco