Trump’s 50-Year Mortgage Plan Sounds Like a Dream — But Experts Say It Could Turn Into a Financial Nightmare

Trump’s Bold Promise: Lower Payments, Bigger Trouble?

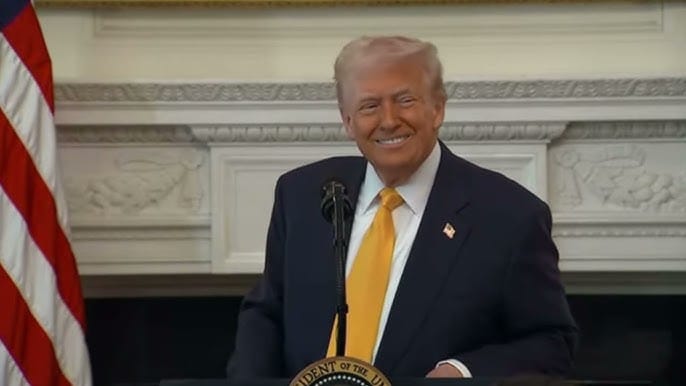

Former President Donald Trump has a new idea to fix America’s housing crisis — a 50-year mortgage. He says it’ll make monthly payments smaller and finally help millions of struggling Americans afford homes.

“All it means is you pay less per month,” Trump said confidently in a recent interview, pitching the plan as the next big thing in housing.

But according to financial experts, this plan could actually make things worse — trapping buyers in decades of debt, costing hundreds of thousands more in interest, and possibly making housing prices even higher.

In short, what sounds like a homebuyer’s dream could easily turn into a financial nightmare.

The Catch Behind Trump’s 50-Year Mortgage

On paper, a 50-year mortgage sounds great. Stretch the loan out longer, and you pay less each month. But what Trump didn’t mention is that those smaller payments come at a massive cost over time.

David Dworkin, president of the National Housing Conference, didn’t mince words:

“A 50-year mortgage destroys the biggest value of homeownership — wealth building.”

Here’s what that means: when you pay off a mortgage, you’re slowly building equity — the part of your home you truly own. But if you’re paying it off over 50 years, it takes forever to actually own anything.

And the interest? That’s where the real pain kicks in.

Lawrence Yun, chief economist at the National Association of Realtors, ran the numbers:

- On a $420,000 home with a 6.3% interest rate, you’d pay about $236 less each month with a 50-year mortgage compared to a 30-year one.

- But in total, you’d pay $1.1 million over the life of the loan — nearly $360,000 more in interest.

In other words, you’d save a few hundred bucks a month but lose the equivalent of a luxury home in interest payments.

The Wealth Trap: Owning a Home You Never Really Own

The longer you take to pay off your home, the slower you build equity. That means you can’t easily sell or upgrade your home because you still owe too much of it to the bank.

Yun summed it up: “The slow equity build would make trading up or down very difficult.”

The situation gets worse when you consider that the average first-time homebuyer in America is now 40 years old. With a 50-year mortgage, they’d finish paying off their loan at age 90 — assuming they live that long.

At that point, you’re not buying a house to build wealth — you’re renting from the bank for life.

Could the Plan Backfire and Make Homes Even Pricier?

Here’s the ironic twist: the plan meant to make homes more affordable could actually make them less affordable.

If buyers suddenly qualify for larger homes because of smaller monthly payments, demand could skyrocket. But since the U.S. is already facing a massive housing shortage, more demand with limited supply means one thing — even higher home prices.

So while the 50-year mortgage might sound like a way to help Americans buy homes, it could actually push prices up further, putting homes even more out of reach.

The Legal Roadblocks: It’s Not That Simple

Even if Trump wanted to make this happen tomorrow, there’s a mountain of red tape standing in the way.

Right now, U.S. housing laws only recognize mortgages up to 30 years as “Qualified Mortgages” — a designation that protects lenders from legal risks. For Trump’s plan to work, the Consumer Financial Protection Bureau (CFPB) would need to rewrite the rules, a process that could take a year or more and require public approval.

In theory, Fannie Mae and Freddie Mac — two government-backed mortgage giants — could help by buying these longer loans from lenders. But as Mortgage Bankers Association spokesperson Falen Pitts pointed out, “Fannie and Freddie are currently banned from buying non-QM mortgages.”

Translation: no rule change, no 50-year mortgage market.

Trump’s Team Sends Mixed Signals

Even inside Trump’s own circle, it’s not clear how serious the idea is.

Federal Housing Finance Agency (FHFA) Director Bill Pulte first called the plan a “complete game changer.” But within 24 hours, he walked it back, saying it was just “one of many tools” the administration is exploring.

White House Economic Director Kevin Hassett also admitted, “There’s a lot of legal analysis, but if it requires legislation, it wouldn’t be imminent.”

So while Trump’s comments made headlines, it’s becoming clear that nothing is happening anytime soon.

Experts Say It’s a Distraction from the Real Problem

Housing experts argue that the 50-year mortgage idea misses the real point — the problem isn’t that loans are too short, it’s that homes are too expensive and too few are being built.

The U.S. is short by millions of homes, and restrictive zoning laws make it hard to build new ones. Adding longer loans doesn’t solve that — it just stretches debt farther into the future.

As Dworkin put it bluntly, “If we want to make housing affordable, we need to make more of it — not make the debt longer.”

The Hidden Consequences: Long-Term Debt, Little Gain

Trump’s 50-year mortgage plan might win political applause from frustrated voters, but the fine print tells another story.

It could:

- Double the total cost of homeownership.

- Delay equity for decades.

- Inflate housing prices even more.

- Trap millions in lifelong debt.

While the lower monthly payments may sound tempting, the long-term cost could be devastating. It’s like buying a car with smaller payments — but agreeing to pay for it for 25 years.

The Bottom Line: A Political Pitch or a Financial Trap?

Trump’s 50-year mortgage proposal may be grabbing headlines, but experts say it’s a dangerous illusion. It promises relief now but quietly shifts the financial burden decades into the future — when homeowners will be too old to care, and too broke to move.

Housing affordability is a serious problem. But the solution, according to economists, lies not in stretching debt longer, but in making homes cheaper to build and easier to buy.

As one analyst put it, “Trump’s 50-year mortgage may cut your payment — but it could also cut your future.”