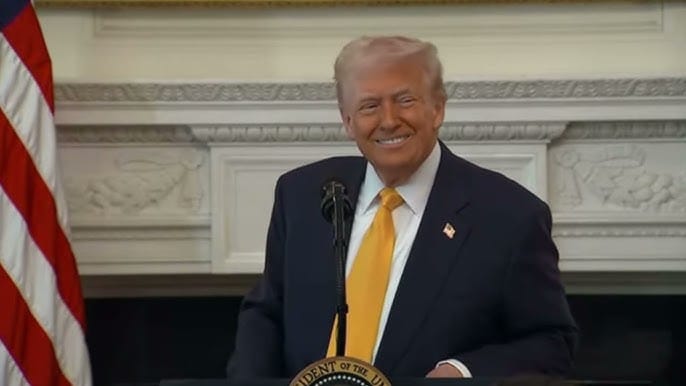

Trump’s $12 Billion Minerals Plan Could Reshape America’s Manufacturing Future

Trump Unveils Project Vault to Secure America’s Mineral Future

President Donald Trump is preparing to launch a massive new initiative aimed at protecting US manufacturers from global supply disruptions. The plan, known as Project Vault, will create a strategic stockpile of critical minerals using $12 billion in initial funding.

The move is designed to reduce America’s heavy dependence on China for rare earths and other essential metals used across industries such as automotive manufacturing, aerospace, energy, and consumer technology.

With supply chains increasingly vulnerable to geopolitical tensions and trade restrictions, the administration sees Project Vault as a long-term safeguard for the US industrial economy.

What Is Project Vault?

Project Vault is a first-of-its-kind mineral stockpiling effort focused on civilian manufacturing needs rather than military use.

While the United States already maintains a national stockpile of critical minerals for defense purposes, this new initiative is designed to support private-sector companies that rely on steady access to key raw materials.

The project will procure, store, and manage critical minerals on behalf of participating manufacturers, allowing them to avoid price shocks and supply shortages without maintaining their own stockpiles.

How the $12 Billion Plan Is Funded

Public and Private Capital Combined

The funding structure behind Project Vault blends government support with private investment.

The initiative includes:

- A $10 billion loan from the US Export-Import Bank

- $1.67 billion in private capital from institutional investors

- Long-term purchase commitments from participating manufacturers

The Export-Import Bank is expected to approve the 15-year loan, which would be the largest deal in the bank’s history, more than doubling its previous record.

Administration officials say the project has already been oversubscribed, reflecting strong investor confidence in the creditworthiness of the companies involved and the government’s backing.

Which Minerals Will Be Stockpiled?

Project Vault will focus on minerals considered essential to modern manufacturing and national economic security.

These include rare earth elements and other critical minerals such as gallium, cobalt, nickel, and antimony. These materials are vital for producing smartphones, electric vehicle batteries, jet engines, semiconductors, renewable energy systems, and advanced electronics.

Many of these minerals are subject to extreme price volatility and are heavily controlled by foreign suppliers, particularly China.

Why Reducing Dependence on China Matters

China dominates both the mining and processing of rare earths and critical minerals, giving it significant leverage over global supply chains.

This vulnerability became especially clear after China tightened export controls on certain materials last year, forcing some US manufacturers to reduce production.

The Trump administration views Project Vault as a strategic countermeasure, aimed at insulating US companies from sudden disruptions caused by trade disputes, sanctions, or geopolitical conflicts.

By building a domestic stockpile and diversifying sourcing, the US hopes to regain leverage and stability.

Major US Companies Join the Initiative

Project Vault already has backing from more than a dozen major corporations spanning multiple industries.

Participants include automotive giants, aerospace leaders, technology firms, and energy companies. Among them are General Motors, Stellantis, Boeing, Corning, GE Vernova, and Google.

These companies rely heavily on consistent access to critical minerals and see the stockpile as a way to stabilize costs and ensure continuity in production.

Role of Commodity Trading Firms

Three major commodities trading houses have signed on to handle procurement for Project Vault.

These firms will be responsible for sourcing the raw materials, navigating global markets, and managing purchases to fill the stockpile efficiently.

Their involvement adds expertise and market access, helping ensure the initiative can operate at scale while responding to price movements and supply conditions.

How Project Vault Will Work for Manufacturers

A Shared Stockpile Model

Instead of each company holding its own reserves, Project Vault allows manufacturers to access a shared pool of materials.

Companies commit in advance to purchase specific quantities of minerals at agreed-upon prices in the future. In return, Project Vault acquires and stores those materials on their behalf.

Manufacturers pay a carrying cost that covers interest on the loan and storage expenses. This model spreads risk and reduces the financial burden of maintaining individual stockpiles.

Protection Against Price Volatility

One of the core goals of Project Vault is to smooth out extreme price swings.

Raw material prices can fluctuate wildly due to geopolitical events, natural disasters, or sudden changes in demand. These swings can wreak havoc on corporate balance sheets and long-term planning.

Under the program, companies also agree to repurchase the same amount of material at the same price later, creating a stabilizing effect that helps suppress volatility across the market.

Access During Supply Disruptions

In normal conditions, manufacturers can draw down their allocated materials as long as they replenish the stockpile.

In the event of a major supply disruption, companies will be allowed to access their full reserves without immediate replacement requirements.

This ensures that production lines can keep running even during global crises.

Market Reaction and Investor Confidence

News of Project Vault triggered a surge in US rare earth and critical minerals stocks during premarket trading.

Several companies in the sector saw sharp gains as investors reacted to the potential for increased demand, government backing, and long-term contracts.

Administration officials say investor interest has been strong due to the project’s structure, long-term commitments, and involvement of a federal export-credit agency.

Part of a Broader Strategy

Project Vault is not an isolated effort.

Under Trump, the US has already taken unprecedented steps to invest directly in domestic mining and processing companies to strengthen the supply chain from the ground up.

The administration has also signed cooperation agreements with countries such as Australia, Japan, and Malaysia, and plans to push for additional partnerships at an upcoming international summit in Washington.

These moves reflect a broader strategy to diversify sourcing, boost domestic capacity, and reduce systemic risk.

Lessons From Past Supply Shocks

Recent history has highlighted how vulnerable mineral supply chains can be.

One notable example was the surge in nickel prices following Russia’s invasion of Ukraine. Fears over supply disruptions sent prices skyrocketing, creating chaos for industries dependent on the metal.

Project Vault is designed to prevent similar shocks from rippling through the US economy.

What Still Isn’t Known

While the framework of Project Vault is clear, some details remain undisclosed.

The identities of the institutional investors providing private capital have not been made public. Specific carrying costs and procurement fees charged to manufacturers are also still unknown.

However, administration officials say these details will be finalized as the project moves closer to launch.

Why Project Vault Is a Big Deal

Project Vault represents a major shift in how the US approaches industrial security.

Rather than reacting to crises after they occur, the administration is building a proactive buffer against future disruptions.

By combining government support, private investment, and long-term corporate commitments, the project aims to stabilize supply chains, reduce volatility, and protect American manufacturing competitiveness.

If successful, Project Vault could become a model for how nations manage strategic resources in an increasingly uncertain global economy.

Final Thoughts

With $12 billion in backing and participation from some of America’s largest manufacturers, Project Vault signals a serious commitment to securing the country’s industrial future.

As geopolitical tensions rise and global supply chains grow more fragile, the initiative reflects a growing recognition that access to critical minerals is not just an economic issue, but a strategic one.

Whether Project Vault delivers on its promise will become clear over time, but one thing is certain — the race to control critical minerals has entered a new phase.