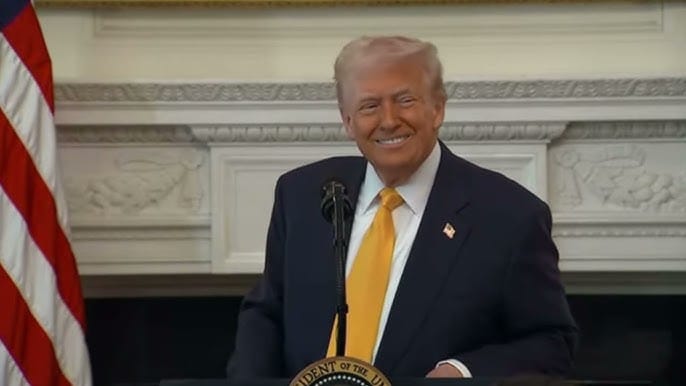

Trump Threatens Iran: Could Oil Prices Skyrocket Like Venezuela

Trump Considers Action Against Iran Amid Rising Unrest

The United States is reportedly considering a strike on Iran as the country faces growing unrest. Widespread protests have erupted across Iranian cities, and the government’s harsh crackdown has drawn international attention. While President Donald Trump has not committed to an attack, he has indicated that the US is monitoring the situation closely and evaluating possible options.

Iran, unlike Venezuela, is a major global oil player with vast reserves and a strategic position, making any potential US intervention a serious event for energy markets worldwide.

Iran’s Massive Oil Industry

Iran produces about 3.2 million barrels of oil per day, roughly 4% of global oil production, according to OPEC. Despite heavy international sanctions, Iran has maintained its oil exports, often through a “shadow fleet” of vessels selling crude at discounted rates.

The country’s potential is even more significant than its current output. Iran holds 209 billion barrels of proven oil reserves, second only to Venezuela and Saudi Arabia. At its peak in the 1970s, Iran produced 6.5 million barrels per day, but current production is less than half that amount.

China remains Iran’s largest oil customer, accounting for 97% of exports in 2024.

Why Iran Matters More Than Venezuela

Experts emphasize that Iran’s role in global oil markets is far more critical than Venezuela’s. Luisa Palacios, a former Citgo chairwoman, noted, “Developments for Iran matter much more for oil markets in the near term because of the risk of oil supply disruption.”

Iran’s strategic location along the Strait of Hormuz, through which roughly 20 million barrels of crude flow daily, gives it the ability to disrupt global oil shipping. Any instability in Iran could directly impact global energy supply, affecting prices and markets.

How Oil Prices Could React

Oil markets are already jittery amid the threat of conflict. Crude prices briefly rose above $61 a barrel following news of potential US action, before retreating slightly as tensions appeared less immediate. Analysts warn that an actual strike could push prices much higher, depending on the scale of the attack and Iran’s response.

Past incidents illustrate this volatility. In early June, crude prices jumped 7% to $74 a barrel amid rising tensions between Israel and Iran. However, after a US strike on Iranian nuclear facilities later that month, prices fell because the oil infrastructure remained untouched and Iran’s retaliatory strikes were largely symbolic.

Iran’s Strategic Influence

Iran’s oil industry is central to its government finances, contributing around half of the country’s revenue, even though oil accounts for just 10-15% of its GDP. Unlike Venezuela, Iran’s infrastructure is relatively well-maintained, meaning a new government could quickly restore production or expand exports.

Experts say that the global impact depends on who takes power if the current regime falls. A pro-Western government could stabilize markets and reduce oil prices over time, while uncertainty in leadership would likely push prices higher.

Long-Term Global Implications

Even if a new government emerges, US oil companies may initially hesitate to invest in Iran. Political stability, security guarantees, and clear economic policies would be prerequisites for foreign investment. Still, Iran’s vast reserves and strategic position mean it will remain a major player in global energy for decades.

Mike Sommers, CEO of the American Petroleum Institute, said, “Iran has significant resources, but any investment depends on political stability.”

Iran’s unrest and potential US intervention pose a unique risk to global oil markets. Unlike Venezuela, Iran’s size, reserves, and control over shipping lanes make any conflict more impactful. Crude prices could spike in the short term, while long-term market effects would hinge on political stability and international relations.

For global energy watchers, Iran is not just another OPEC country—it’s a geopolitical and economic linchpin whose fate could reshape energy markets around the world.