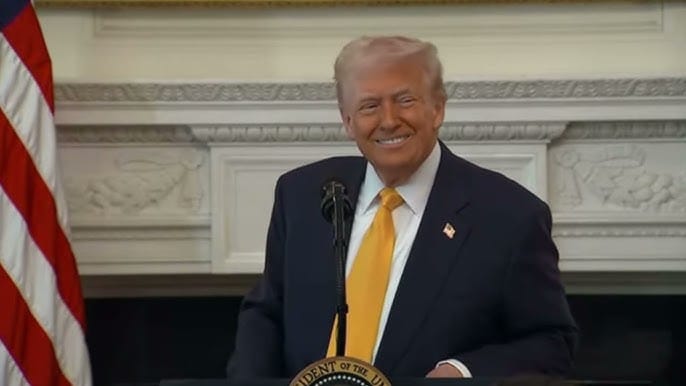

Trump Heads to Asia to Cut Billion-Dollar Mineral Deals and Corner Xi Jinping

A High-Stakes Trip to Asia

President Donald Trump is heading to Asia with a clear mission — to strike key economic and mineral supply deals that could shift the global balance of power. According to senior U.S. officials, Trump aims to strengthen America’s access to critical minerals, boost U.S. investments, and increase pressure on China just before his highly anticipated meeting with President Xi Jinping.

The tour will include stops in Malaysia, Japan, and South Korea. Trump will attend major regional summits — the Association of Southeast Asian Nations (ASEAN) gathering in Malaysia and the Asia-Pacific Economic Cooperation (APEC) summit in South Korea — before sitting down face-to-face with Xi. The meeting is expected to be one of the most closely watched diplomatic moments of the year, as the two leaders look to navigate trade tensions that have once again flared between Washington and Beijing.

The Focus: Critical Minerals and Economic Power

At the heart of Trump’s Asia strategy is one of the world’s most sought-after resources — critical minerals. These minerals, including rare earth elements, are essential for manufacturing technology, defense systems, and renewable energy products.

In recent months, China has imposed tighter export controls on these materials, using its dominance in the supply chain as leverage in ongoing trade disputes. Trump’s response has been swift and strategic: find new allies, lock in new supply sources, and reduce America’s dependence on China.

“Trump wants to build stronger, more secure supply chains that don’t rely on China,” one senior U.S. official said before the trip. “This visit is about building new partnerships that help both the U.S. and the region grow.”

A Deal Pipeline Worth Billions

Trump’s administration has already made moves ahead of the Asia tour. Earlier this week, he signed a major $8.5 billion agreement with Australian Prime Minister Anthony Albanese to boost U.S. access to Australian critical minerals. The deal is part of a broader plan to create an international pipeline of resources that supports U.S. industries — from semiconductors to electric vehicles.

Now, Trump is hoping to replicate that success in Asia. Officials say the upcoming agreements could focus on opening mining projects, technology transfers, and long-term contracts to ensure steady supply chains. While no specifics were given, the White House has framed these deals as vital for economic security and national defense.

Turning Up the Pressure on China

Trump’s Asia trip comes amid escalating trade tensions. The U.S. president has threatened to impose an additional 100% tariff on Chinese goods by November 1 if Beijing doesn’t ease its new mineral restrictions.

In a calculated move ahead of his meeting with Xi, Trump also announced a new investigation into whether China has violated the terms of a limited trade deal signed during his first term. The investigation could pave the way for more tariffs — a clear signal that Washington is preparing for another hard-line phase in its trade strategy.

China’s control over the global rare earth market has long been a source of friction. These minerals are crucial for industries like defense, aerospace, and electronics. By cutting exports, Beijing can disrupt production lines in the U.S. and Europe — a risk Trump’s administration is determined to eliminate.

What Trump Wants from Xi

Beyond minerals, Trump is expected to push Xi on several key issues during their one-on-one meeting. Washington wants Beijing to resume large-scale purchases of American soybeans, a move that would support U.S. farmers hit by previous trade restrictions. The U.S. is also seeking stronger Chinese action to stop the flow of fentanyl — a synthetic opioid fueling America’s drug crisis.

Additionally, Trump is likely to urge Xi to use China’s influence over Russia to help bring an end to the war in Ukraine. Analysts say the U.S. hopes to frame cooperation on global security as a potential benefit if China eases trade tensions.

Another major topic on the table is a tariff agreement between the two countries that is set to expire in November. Extending that deal could provide short-term relief for businesses on both sides of the Pacific.

Meetings with Japan and South Korea

During his Asia visit, Trump will also hold bilateral meetings with key allies. In Japan, he is scheduled to meet Prime Minister Sanae Takaichi, where discussions are expected to center on technology cooperation, supply chain resilience, and regional security.

In South Korea, Trump will meet President Lee Jae Myung to finalize a new trade and investment agreement. Seoul is eager to secure lower tariffs on its exports to the U.S., while Washington wants to strengthen its economic and military partnership in the region.

Observers say these meetings underscore a broader U.S. strategy — to build a coalition of Asian economies that can counterbalance China’s growing influence in the region.

A Test of Economic Diplomacy

Trump’s trip to Asia represents more than a trade mission — it’s a test of economic diplomacy at a time when global supply chains are being redefined. The president’s focus on minerals, manufacturing, and investment is designed to show that the U.S. can still lead in the race for critical resources.

For Trump, success would mean securing tangible deals that deliver jobs and energy independence at home, while signaling to Xi that the U.S. is ready to compete on every front — from trade to technology.

What’s at Stake

If Trump can seal mineral agreements across Asia, it would mark a major step toward reducing China’s stranglehold on global supply chains. But failure could embolden Beijing, giving Xi more leverage in future negotiations.

As the clock ticks toward the November 1 tariff deadline, both leaders have powerful incentives to find common ground. Yet, with nationalist sentiment rising on both sides, any breakthrough is far from guaranteed.

The world will be watching closely when Trump and Xi meet — not just for the handshake, but for what it means for the next phase of global trade and power politics.