The End of American Economic Exceptionalism? How Trump’s Trade Reset Is Rewriting Global Power

How the World Is Turning America’s Economic Strategy Back on Itself

For more than a decade, the United States enjoyed a rare and powerful economic advantage. Growth was strong, corporate profits surged, and inflation stayed surprisingly contained. According to a top Morgan Stanley economist, that era of American economic exceptionalism is now fading, and the reason is simple: the rest of the world is learning how to use the same tools that once made the US dominant.

The second Trump administration has accelerated this shift. By aggressively rewriting global trade relationships, Washington has unintentionally exposed the mechanics behind America’s success, giving other countries a blueprint to strengthen their own economies.

What Powered America’s Economic Boom

The Three Forces Behind US Dominance

Speaking at a recent global outlook roundtable, Morgan Stanley Wealth Management’s chief investment officer Lisa Shalett explained that America’s strong performance over the last 15 years rested on three critical pillars.

First was monetary stimulus. Ultra-low interest rates and easy money policies helped fuel investment, lift asset prices, and encourage borrowing.

Second was fiscal stimulus. Massive government spending, tax cuts, and deficit-funded programs injected cash directly into the economy, supporting growth even during crises.

The third, and often overlooked, pillar was imported disinflation from China. By importing vast quantities of inexpensive goods, the US kept consumer prices low even as demand surged. This allowed wages, profits, and asset values to rise without triggering runaway inflation.

Together, these forces created an unusually favorable environment for businesses and consumers alike.

Why This Combination Was So Powerful

This trifecta was extraordinarily effective because it avoided the usual trade-offs. Normally, heavy stimulus leads to higher inflation. But cheap imports absorbed much of that pressure.

As a result, companies enjoyed strong earnings growth while households benefited from stable prices. For investors, it was a golden age of returns.

The Turning Point: Trump’s Trade Reset

Liberation Day and the New Trade Reality

That system began to unravel on April 2, 2025, a date the Trump administration dubbed Liberation Day. On that day, the US signaled a fundamental shift in how it approaches global trade, pressing new terms with virtually every trading partner.

Instead of relying on open trade flows to keep prices down, America moved toward a more confrontational, deal-by-deal strategy. The message was clear: access to the US market would come with stricter conditions.

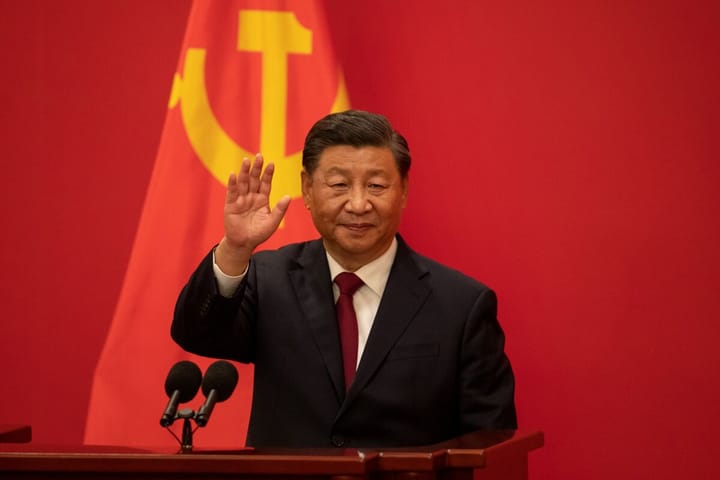

While many countries chose to negotiate quietly, China pushed back openly. As trade routes began to shift, the global economy started to reorganize itself around this new reality.

The Unintended Consequence

By stepping away from its role as the world’s primary importer of cheap goods, the US effectively freed up a massive supply of disinflation for other nations.

In doing so, it revealed how powerful imported disinflation can be when combined with stimulus. Other countries are now eager to replicate the model that once worked so well for America.

How Other Countries Are Leveraging the Same Playbook

Fiscal Stimulus Through Defense Spending

One of the most visible changes is in global defense budgets. NATO countries have agreed to dramatically increase military spending, responding to US pressure and rising geopolitical risks.

Where member states once spent around 2 percent of GDP on defense, the new target is 5 percent. This represents a huge wave of fiscal stimulus, creating jobs, boosting manufacturing, and driving investment in advanced technologies.

From an economic perspective, defense spending acts much like infrastructure investment, injecting money into domestic economies and supporting long-term growth.

Imported Disinflation Finds New Homes

With the US importing fewer Chinese goods, those products are flowing elsewhere. Data from China’s General Administration of Customs shows exports rose sharply late last year, even as shipments to the US collapsed.

Chinese exports increased 6.6 percent year on year in December, reaching $357 billion. At the same time, exports to the US fell by 30 percent, marking the ninth straight monthly decline.

This suggests other countries are now benefiting from lower-cost imports that once helped keep US inflation in check. For consumers abroad, that means cheaper goods. For policymakers, it means more room to stimulate without sparking inflation.

Monetary Policy Joins the Party

The final piece of the puzzle is monetary easing. Many central banks have already begun cutting interest rates or signaling they will soon do so.

The European Central Bank, the Bank of England, and central banks in Australia, New Zealand, and Canada have all moved toward looser policy.