Super Micro Confident in Meeting SEC Deadline and Achieving $40 Billion Revenue in Fiscal 2026

Super Micro Computer, the high-performance computing solutions leader, has reaffirmed its confidence to meet the filing deadline of the U.S. Securities and Exchange Commission (SEC) while having an aggressive $40 billion revenue goal for fiscal 2026. In spite of recent losses, such as a delay in reporting annually and updated revenue guidance for fiscal 2025, the company still has faith in its long-term growth path.

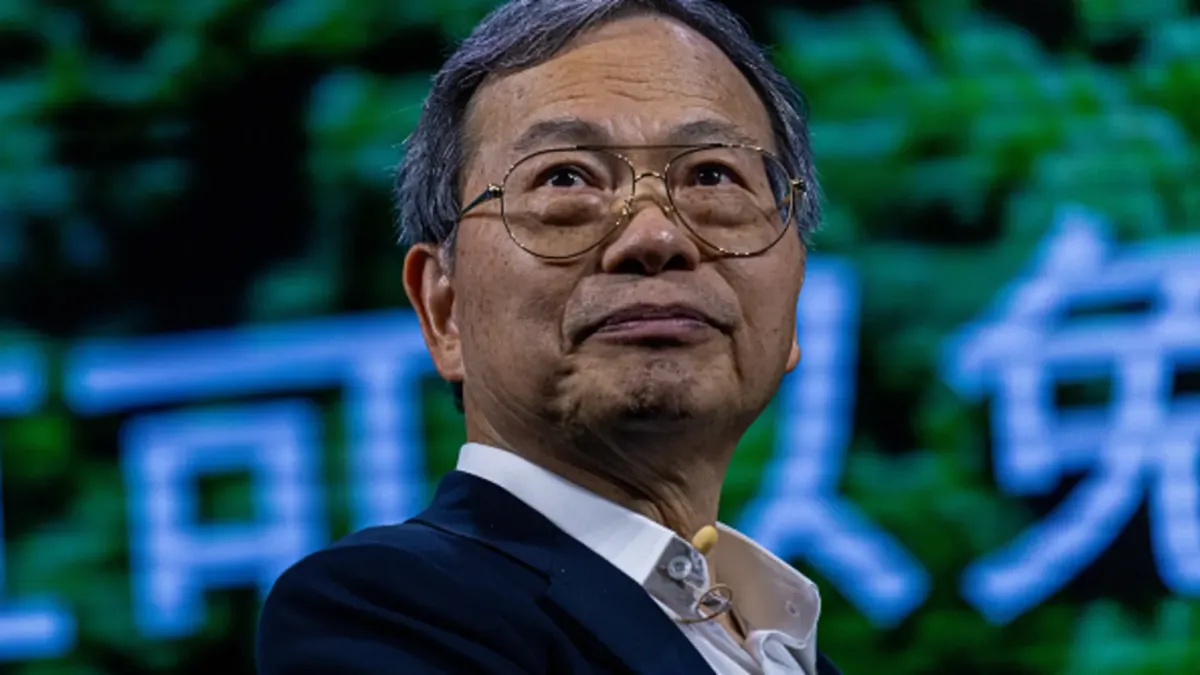

CEO Charles Liang's Reassurance

CEO Charles Liang has promised stakeholders that the company will submit its delayed annual report to the SEC within the February 25 deadline. This promise comes as the company faces fears of Nasdaq delisting due to governance concerns that prompted the company's auditor to resign in October. Liang affirmatively stated that Super Micro is exerting great efforts to comply with its obligations, reiterating investor confidence in the stability of the company.

Revenue Projections: Short-Term vs. Long-Term Outlook

Super Micro's top-line forecasts have also been volatile. In fiscal year 2025, the company lowered its revenue guidance to $23.5 billion to $25 billion from an earlier estimate of $26 billion to $30 billion. LSEG-polling analysts had predicted revenues of around $24.9 billion for the period.

Yet, for fiscal 2026, the company is projecting a bold revenue target of $40 billion. This is well above analysts' expectations of $30 billion and shows the confidence the company has in its growth prospects, especially in the artificial intelligence (AI) and cloud computing space.

Stock Performance and Market Response

Despite concerns surrounding governance and financial reporting delays, Super Micro’s stock surged by as much as 10% in extended trading following its latest earnings announcement. The stock remains up about 27% in 2025 but is still below its March 2024 peak.

The growth opportunities of the company are closely linked to its AI infrastructure solutions. Super Micro's servers, which are driven by Nvidia's graphics processing units (GPUs), have become increasingly popular as AI adoption keeps growing. This has placed the company in a good position as technology giants such as Meta, Amazon, Alphabet, and Microsoft intend to spend up to $320 billion on AI initiatives this year.

Challenges and Risks

Though Super Micro is optimistic about its future, a number of issues still linger:

Regulatory Compliance: The company needs to ensure it complies with the SEC deadline to escape Nasdaq delisting.

Revenue Volatility: The downward revision of fiscal 2025 guidance is a concern regarding demand volatility.

Competitive Landscape: AI infrastructure continues to be highly competitive, with competitors also looking to ride the wave of the industry's high growth.

Frequently Asked Questions (FAQs)

Why did Super Micro delay its annual report?

Super Micro held up its annual report amid governance concerns, prompting its auditor to resign. The firm has since been trying to address those issues and comply with the SEC's Feb. 25 deadline.

What is powering Super Micro's long-term revenue growth expectations?

Super Micro's expansion is driven mainly by growing demand for AI infrastructure, cloud computing, and high-performance servers. Super Micro is also helped by powerful partnerships with market leaders such as Nvidia, whose GPUs drive most of its systems.

What has been the stock market's response to Super Micro's recent news?

Super Micro's shares rose 10% in extended trading after its most recent earnings report. Although the stock is still volatile, investor sentiment has been supported by the long-term growth prospects of the company.

What are some challenges that may affect Super Micro's ability to meet its revenue goal?

Challenges are to meet regulatory timelines, deal with fluctuations in revenue, and contend with fierce competition in the AI infrastructure market. Any non-compliance with SEC standards could also result in a Nasdaq delisting, affecting investor perception.

Where is Super Micro placed in the AI space?

Super Micro is a leading player in AI infrastructure, offering high-performance servers designed to support AI workloads. As big tech players heavily invest in AI, Super Micro stands to gain from the trend.

Super Micro is bullish on surmounting regulatory obstacles and recording sizeable revenue expansion in the years ahead. Despite near-term obstacles, the company's solid placement in AI and cloud computing and its aggressive fiscal 2026 revenue goal signal its long-term promise. Shareholders and analysts will be closely watching its move to meet the SEC deadline and fulfill its fiscal obligations.