Stocks Surge as Investors Brace for US Election Results: Key Market Moves and Global Impact

Global stocks rise as investors eagerly await the US presidential election outcome. Market trends, key issues, and potential impacts on the economy, from tariffs to regulations.

Stocks Rise as Global Markets Await US Election Results

With the world closely watching the US presidential election, global markets are experiencing notable movements as investors try to anticipate the outcome and its impact on the global economy. The result of the election, particularly in the key battleground states, will likely influence major economic policies, trade relations, and market trends across the globe, especially in Asia.

Market Movements: Global Stocks React to Uncertainty

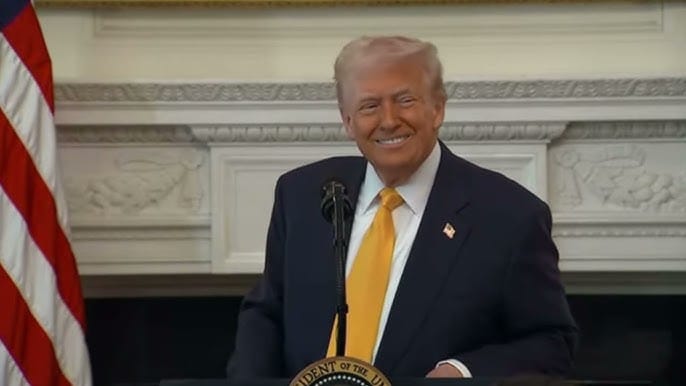

On Wednesday, benchmark stock indexes across Asia were mostly higher, as optimism rose despite the uncertainty surrounding the election outcome. Investors are betting on a more predictable future depending on who wins the race between Donald Trump and Kamala Harris.

Key Asian Markets Performance

- Japan’s Nikkei 225 surged 2%, showing investor confidence amid uncertainty.

- Australia's ASX 200 rose by 1%, reflecting similar optimism.

- In China, the Shanghai Composite stayed flat, while Hong Kong’s Hang Seng was down by about 2.5%.

Meanwhile, US futures trading indicated positive market sentiment with major indexes like the Dow Jones, S&P 500, and Nasdaq all closing 1% higher. Bitcoin also made headlines, hitting a record high above $75,000, signaling growing confidence in digital assets amid uncertain times.

Currency Movements: The US Dollar Strengthens

The US dollar saw a significant uptick, rising over 1% against other major currencies, including the euro, pound, and yen, as markets brace for the outcome. This rise in the dollar reflects the growing demand for safe-haven assets amid the political uncertainty surrounding the US election.

Trump vs. Harris: How Election Outcomes Could Shape the Global Economy

The election result will not only determine the future leadership of the US but also shape global trade and economic policies.

If Trump Wins: Protectionism and Business-Friendly Policies

If Donald Trump wins a second term, his trade policies could cause ripples in global markets, particularly in Asia. Trump has pledged to dramatically increase trade tariffs, especially targeting China, which has caused concerns among investors.

- Trump’s protectionist policies could lead to heightened tensions between the US and China, especially with his stance on Taiwan, a major producer of semiconductor chips crucial for global technology supply chains.

- On the other hand, Trump’s tax cuts and pro-business policies could stimulate growth in the US, but might lead to inflation and fewer interest rate cuts by the Federal Reserve. For investors, this could mean a more favorable environment for American companies but increased global market volatility.

If Harris Wins: A Return to Stability and Green Policies

A Kamala Harris administration is expected to bring more predictability to global markets, particularly in trade. Investors are likely to see Harris’ foreign policies as a continuation of Joe Biden’s more global trade-friendly approach. This includes a more balanced stance on tariffs and an emphasis on international cooperation.

- Harris is also expected to implement stricter regulations on sectors like banking and healthcare, which could have mixed effects on US markets.

- Renewable energy policies under Harris could boost electric vehicle (EV) companies and solar energy firms, creating opportunities for investors focused on sustainable and clean energy technologies.

Global Economic Indicators to Watch: US Fed and China’s Slowdown

In addition to the election outcome, there are other major economic events investors are eyeing this week:

- US Federal Reserve Interest Rate Decision: On Thursday, the Federal Reserve will announce its latest interest rate decision. Comments from Jerome Powell, the Fed Chairman, will be closely scrutinized as investors try to gauge the future path of US monetary policy and its potential impact on the economy.

- China’s Economic Plans: On Friday, Chinese officials are expected to announce more details about their efforts to combat the economic slowdown in the world’s second-largest economy. These updates will be crucial for global trade and supply chains, especially with China’s role in the technology and manufacturing sectors.

Conclusion: Investors Await Clarity Amidst Global Uncertainty

While stock markets are rising globally as they await the US election outcome, there’s still significant uncertainty surrounding the final result. Whether it’s Trump’s aggressive trade policies or Harris’ stable approach to global trade, the market is positioning itself for a shift in US economic leadership.

As investors prepare for both the US election results and upcoming economic announcements, the next few days will be critical in determining the trajectory of global markets.