Stargate in Trouble? Trump’s Tariffs Threaten $500 Billion AI Mega Plan

Trump’s New Tariffs Could Derail Big Tech’s AI Data Center Boom

Heavy Tariffs May Delay AI Expansion, Raise Costs, and Slow Innovation

President Donald Trump’s latest move to impose steep tariffs on foreign technology imports may backfire on his own ambition to make the U.S. a global leader in artificial intelligence (AI). Experts warn that the new duties could significantly increase the cost of building AI data centers, potentially causing major players like Microsoft, Amazon, and Google to slow down or scale back their expansion plans.

What the New Tariffs Mean for Big Tech

Trump Hits Key Tech Countries with Huge Duties

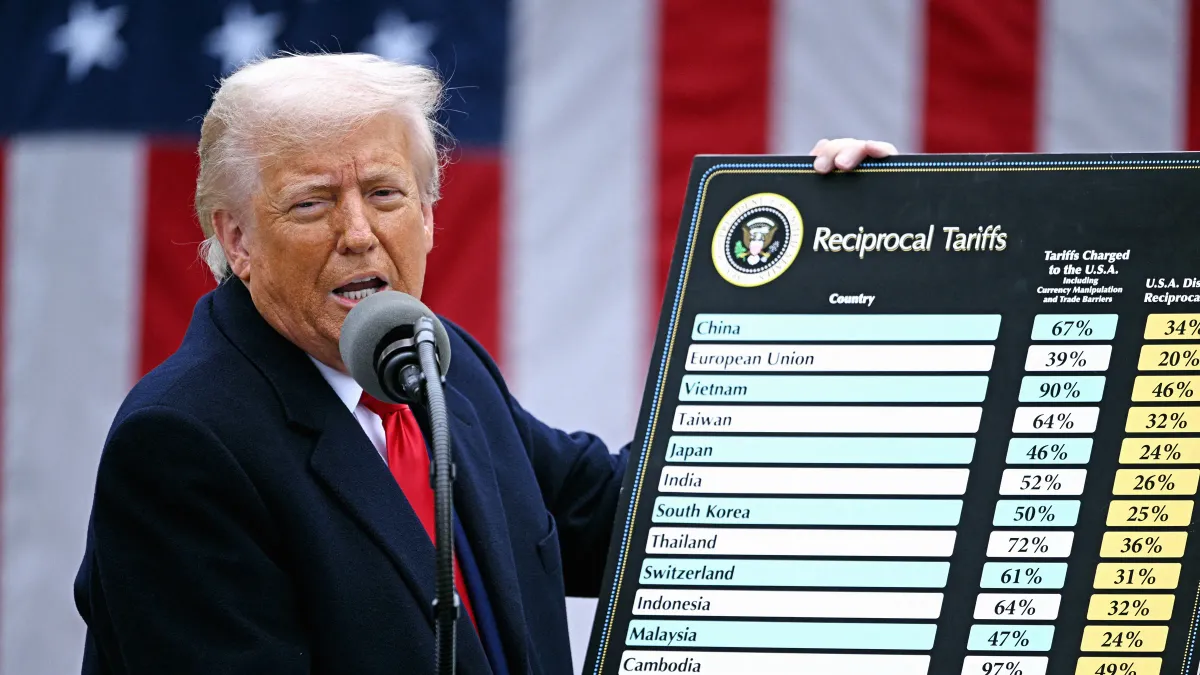

On Wednesday, Trump imposed high tariffs on several key U.S. technology partners:

- 34% on China

- 32% on Taiwan

- 25% on South Korea

- 10% baseline tariff on all global imports

These tariffs are part of a sweeping economic policy meant to promote domestic manufacturing and bring supply chains back to the U.S. However, critics argue they could stifle investment in critical infrastructure like data centers, especially for AI development.

Electronics Are at the Heart of the Storm

Billions in Tech Hardware Now More Expensive

According to Census Bureau data, electronics—including PCs, smartphones, and data-center equipment—were the second-largest category of U.S. imports in 2023, worth almost $486 billion. Bernstein analysts estimate that imports of data-processing machines alone could total around $200 billion in 2024, largely sourced from Mexico, Taiwan, China, and Vietnam.

With many of these items now subject to tariffs, costs for tech giants will rise sharply.

Tech Giants May Pull Back on AI Spending

Capital Expenditures Could Shift Due to Tariff Shock

“Expect major players in AI infrastructure and consumer tech to reallocate short-term spending away from expansion and toward procurement hedging or sourcing shifts,” said Abhishek Singh, partner at Everest Group.

In simpler terms, companies might now spend more on finding alternative suppliers or stockpiling equipment than on building new data centers.

Semiconductors Exempt—For Now

Future Tariffs on Chips Could Still Arrive

While semiconductors were spared in the current tariff rollout, the White House may introduce targeted tariffs on chips later, which would further complicate things.

Industry leaders like Intel, Nvidia, AMD, and TSMC (Taiwan Semiconductor Manufacturing Company) are carefully watching the situation. AMD said it's “assessing the details,” while others declined to comment.

Even without direct chip tariffs, the circuit board assemblies that contain these chips might still be taxed, affecting production costs across the board.

Stock Market Reaction: Red Flags for Tech Investors

Major Tech Stocks Take a Hit

The market didn’t react well to the news:

- Nvidia, AMD, and Broadcom shares dropped between 7% to 10%

- TSMC’s U.S.-listed shares fell 7.6%

- Amazon and Alphabet each fell over 4% and 9%, respectively

- Microsoft dropped 2.4%

Intel was a rare exception, gaining 2.1% after reports of a potential joint venture with TSMC.

Microsoft, Amazon, and Alphabet Already Slowing Down

Cloud Giants Rethinking Data Center Plans

“There’s no doubt that the equipment that goes into data centers will become significantly more expensive,” said Gil Luria, analyst at D.A. Davidson.

Microsoft, in particular, has already shown signs of caution. According to TD Cowen, the company abandoned data-center projects in both the U.S. and Europe capable of using 2 gigawatts of electricity—enough to power a small city—due to oversupply and uncertain demand.

Stargate: The $500 Billion AI Dream in Danger

Trump’s Tariffs Could Sink America’s Biggest AI Project

Earlier this year, Trump unveiled Stargate, a $500 billion AI infrastructure project spearheaded by OpenAI, Oracle, and SoftBank. The vision? To build 20 massive data centers across the U.S. and outpace China and other global competitors in AI development.

But experts now believe the project may not survive the financial shock.

“Stargate was already unlikely to get to that scale even before these tariffs,” said analyst Gil Luria. “Now, it’s highly unlikely such a risky venture will be able to raise anywhere near that number in terms of debt financing.”

Cloud Companies May Face Major Cutbacks

Tariffs Could Trigger Industry-Wide Spending Slowdown

According to HSBC analysts, the cloud sector could see a major drop in spending next year, especially as economic uncertainty grows. Nvidia, which has been one of the biggest winners of the AI boom, is already facing lowered price targets from analysts.

Ben Barringer, a global tech analyst at Quilter Cheviot, said the combination of tariffs and a tough economy could lead to “demand destruction.”

“That means cutbacks on software and cloud spending,” he explained. “Alphabet will see a double whammy—reduced cloud demand and lower digital advertising revenue. Meta is also likely to be affected.”

What Happens Next?

Will Big Tech Adapt or Retreat?

If the tariffs stay in place or expand to semiconductors and related components, Big Tech may have to rethink global supply chains, pause large-scale projects, or pass increased costs onto consumers.

The impact on AI innovation in the U.S. could be substantial, and ironically, the push to strengthen American tech leadership may end up weakening it instead.

Will Tariffs Hurt More Than They Help?

President Trump’s tariff strategy aims to make America stronger by bringing manufacturing back home and reducing reliance on foreign countries. But in the process, it could cripple key investments in AI and cloud computing, industries that are vital to U.S. tech dominance.

For now, all eyes are on whether exemptions will be expanded, or whether Big Tech will find a way to innovate around the roadblocks. One thing is clear: the AI race just got a lot more complicated.