Samsung Shares Hit 4-Year Low Amid Trump’s Tariff Threats and AI Chip Lag

Samsung Electronics' shares drop to a 4-year low, as fears of U.S. tariffs and AI chip competition with rivals like SK Hynix and Nvidia grow.

Samsung Shares Plunge as Trump Tariffs and AI Chip Race Worsen

Shares of Samsung Electronics, the world's largest memory chip maker, have hit their lowest levels in more than four years. The drop comes as investors grow concerned about the potential impact of U.S. tariffs under a new Donald Trump administration, along with Samsung’s failure to capitalize on the booming demand for artificial intelligence (AI) chips.

Trump’s Tariff Threats Weigh on Samsung

One of the primary factors driving Samsung’s stock decline is the threat of tariffs imposed by former President Donald Trump on Chinese imports. If Trump reintroduces these tariffs, analysts warn that Samsung could be hit harder than its competitors due to its higher reliance on Chinese customers. In particular, the potential tariffs could hurt demand for Samsung’s products in the global electronics market, which already faces increasing competition.

AI Chip Demand: Rivals Surpass Samsung

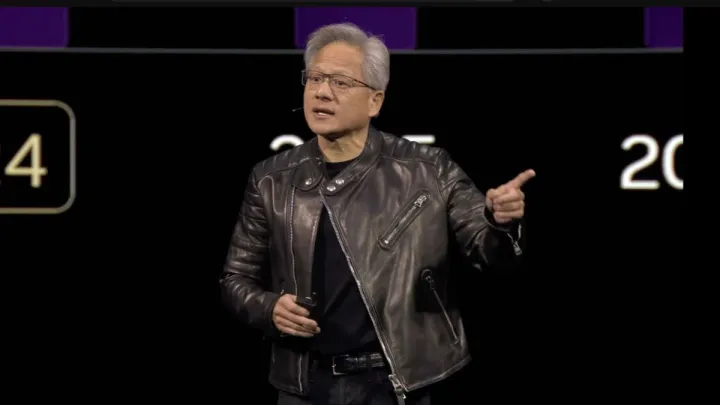

While Samsung has struggled to meet the surging demand for AI chips, other players like SK Hynix, a South Korean competitor, have managed to capture the market, especially in the high-end AI server chip sector. Hynix has been able to increase sales to key U.S. customers like Nvidia, which has seen its shares soar by 199% this year. Meanwhile, Samsung’s position has weakened, with its shares falling 34% year-to-date.

The Broader Impact of U.S. Tariffs on the Chip Industry

The threat of tariffs also comes amid broader concerns within the South Korean tech industry. President Yoon Suk Yeol of South Korea has raised alarms that if Trump’s tariff proposals are enacted, Chinese rivals could reduce their prices, undercutting Korean chip firms overseas. This could further erode Samsung’s competitiveness, especially in key markets.

Samsung’s Struggles: Worst Annual Performance in Decades

Samsung’s share price has been under pressure for months. The company’s stock fell 2.1% on Wednesday, continuing its fourth consecutive session of losses. At 51,700 won, Samsung’s shares are at their lowest point since June 2020. In contrast, rivals like SK Hynix have seen their stocks rise by 32% this year, signaling a stark contrast in performance.

Looking Ahead: Will Samsung Recover?

While Samsung remains South Korea’s most valuable stock, its struggles this year have led many to question whether it can regain its competitive edge in the global chip market. With increasing pressure from rivals and the looming threat of U.S. tariffs, Samsung faces a challenging road ahead.