Nvidia's Slow Growth and Geopolitical Tensions Weigh on Markets, But Bitcoin Soars Toward $100K

Nvidia's revenue growth disappointment drags markets, while Bitcoin surges toward $100K amid Trump expectations. Adani Group faces crisis following bribery indictment.

The stock market is grappling with mixed sentiment as Nvidia’s disappointing earnings forecast drags on investor confidence, while Bitcoin surges toward $100,000, driven by speculation around favorable crypto policies under a possible Trump 2.0 administration.

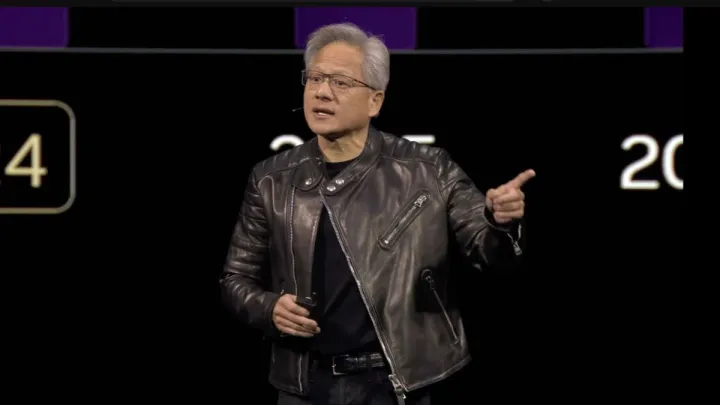

European stock futures are set for a muted start following Nvidia's projection of the slowest sales growth in seven quarters. For a company that has been at the forefront of the AI boom, the news was underwhelming and sent ripples through the broader market. Nvidia's slowdown is particularly concerning as it impacts the tech sector, which has driven recent market rallies.

With limited economic reports due today, European tech stocks—already at a three-and-a-half-month low—are expected to continue their downturn. Investors are also keeping a close eye on geopolitical concerns, which are adding to the market's unease.

Meanwhile, the Adani Group is making headlines after its chairman, Gautam Adani, was indicted in a U.S. bribery case linked to a $265 million scheme. The fallout has been swift, with Adani Group stocks plunging between 10% and 20%, and its dollar bonds also taking a hit.

On the currency front, the U.S. dollar remains strong, staying near a one-year high as investors brace for higher U.S. interest rates, particularly after Donald Trump's recent electoral victory. Expectations are rising that Trump’s tariffs and inflationary policies will push the dollar higher.

Yet, the real buzz in markets today is Bitcoin. The cryptocurrency has rallied 40% in the last two weeks, touching an all-time high of $97,798, with $100,000 on the horizon. Investors are betting that a second Trump presidency will bring crypto-friendly regulations, boosting Bitcoin’s appeal as a hedge and an investment.

Key economic updates to watch today:

- France's business climate index for November

- Eurozone’s consumer confidence flash for November