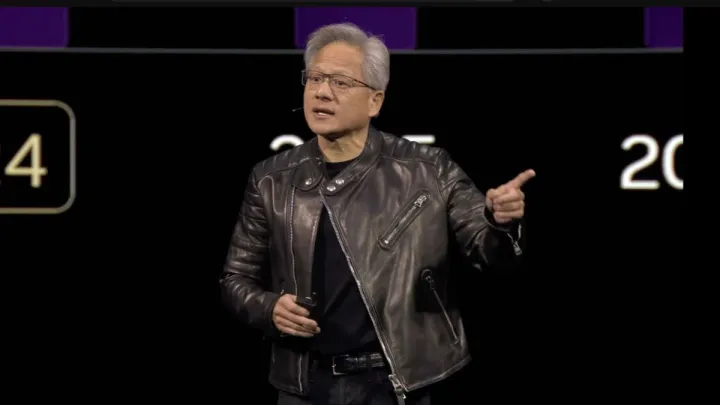

Nvidia’s $2 Billion CoreWeave Investment Sparks Debate — Jensen Huang Responds

Jensen Huang Responds to Critics Over Nvidia’s $2 Billion CoreWeave Investment

Nvidia CEO Jensen Huang has made it clear that he is done entertaining criticism about the company’s investment strategy.

After Nvidia announced a $2 billion investment in cloud computing company CoreWeave, questions quickly followed. Some investors and analysts suggested the deal was another example of so-called circular financing — where AI chipmakers invest in companies that then turn around and buy their products.

Huang strongly disagrees.

In recent interviews, the Nvidia chief executive dismissed the idea outright, calling it “ridiculous” and insisting that these investments are being misunderstood.

What Is the CoreWeave Deal?

Nvidia Expands Its Stake in a Key AI Partner

Under the new agreement, Nvidia is increasing its investment in CoreWeave by purchasing $2 billion worth of the company’s shares. CoreWeave is a fast-growing cloud infrastructure provider focused on AI workloads.

According to a joint statement, the funds will be used to help CoreWeave acquire land, power, and physical infrastructure to build large-scale AI data centers — often referred to as AI factories.

These facilities will eventually be powered by Nvidia’s chips, which are widely considered the industry standard for training and running advanced AI models.

Why Some Investors Are Worried

Concerns About Circular Financing

The criticism around Nvidia’s investments centers on a broader concern in the tech world: whether the AI boom is being fueled by a closed loop of money.

Some investors argue that when Nvidia invests in AI startups or infrastructure companies — many of which are also its customers — it creates the appearance of a feedback loop. In this scenario, Nvidia supplies chips, invests capital, and benefits again when those companies use its products.

This pattern has led to questions about whether AI spending is truly organic or being artificially supported by chipmakers themselves.

Jensen Huang’s Clear Response: “It’s Ridiculous”

Investments as a Vote of Confidence

Jensen Huang addressed these concerns head-on in interviews with Bloomberg News and CNBC.

He explained that Nvidia’s investments are not meant to prop up customers, but to show confidence in what he calls “generational companies” — businesses that are expected to shape the future of technology.

Huang emphasized that Nvidia’s financial contributions represent only a small fraction of the total capital these companies must raise to execute their plans.

According to him, the idea that Nvidia’s investments meaningfully distort the market misunderstands the scale of modern AI infrastructure projects.

The Bigger Picture: AI Infrastructure Costs Are Massive

Nvidia’s Share Is Only a Small Piece

To illustrate his point, Huang referenced the enormous budgets involved in AI expansion.

For example, OpenAI is reportedly committed to spending around $1.4 trillion over the next eight years, largely on data centers and computing infrastructure. Compared to that number, Nvidia’s investments represent a very small percentage.

Huang stressed that even when Nvidia invests billions, it is still just a fraction of what these companies need to raise from multiple sources to support long-term growth.

From his perspective, calling these deals circular ignores the sheer scale of capital required to build the AI ecosystem.

Nvidia’s History of Defending Its Business Model

This Is Not the First Time Nvidia Has Pushed Back

The CoreWeave controversy is just the latest example of Nvidia defending its financial strategy.

In November, Nvidia sent a formal letter to Wall Street analysts after high-profile investor Michael Burry raised concerns about the company’s valuation and financial sustainability.

Burry, known for predicting the housing market collapse portrayed in The Big Short, questioned whether Nvidia’s growth was built on solid foundations or driven by speculative enthusiasm around AI.

Nvidia’s Response to Michael Burry’s Claims

Standing Firm on Transparency and Integrity

In its response, Nvidia stated that its business fundamentals are strong, its financial reporting is transparent, and its leadership takes reputation seriously.

The company emphasized that demand for its chips is real and driven by tangible needs across industries ranging from cloud computing to scientific research.

Nvidia made it clear that it does not see itself as repeating the mistakes of past tech bubbles.

Why the AI Bubble Comparison Keeps Coming Up

Echoes of the Dotcom Era

Despite Nvidia’s confidence, some skeptics continue to draw parallels between today’s AI boom and the dotcom bubble of the late 1990s.

Michael Burry himself clarified that he is not accusing Nvidia of fraud, but instead comparing its position to that of Cisco before the dotcom crash — a company that was highly successful, widely adopted, and still saw its stock collapse when the market corrected.

This comparison has fueled ongoing debate about whether AI investment levels are sustainable over the long term.

Nvidia’s Argument: Demand Is Real, Not Speculative

Chips Are Being Used, Not Stockpiled

Nvidia’s core defense rests on one key claim: its products are not being bought on speculation alone.

The company argues that AI chips are actively being deployed in real-world applications, from training large language models to powering enterprise software and scientific simulations.

According to Nvidia, the demand it is seeing reflects genuine usage rather than hype.

Why CoreWeave Matters to Nvidia’s Strategy

Supporting the Infrastructure That Runs AI

From Nvidia’s perspective, CoreWeave is not just a customer — it is part of the backbone of the AI economy.

Cloud providers like CoreWeave play a crucial role in delivering computing power to companies that cannot build their own data centers.

By supporting these infrastructure builders, Nvidia believes it is helping expand the overall AI market rather than recycling capital within a closed system.

What This Means for Investors

Confidence Versus Caution

For investors, Nvidia’s stance presents a clear divide.

Supporters see a company investing strategically to ensure its technology ecosystem continues to grow.

Critics remain cautious, warning that concentrated investments among interconnected companies can increase risk if AI demand slows.

Huang’s message is clear: Nvidia sees its investments as calculated, limited, and rooted in long-term confidence rather than short-term financial engineering.

The Debate Is Far From Over

As AI spending continues to rise, scrutiny of Nvidia’s role at the center of the ecosystem is unlikely to fade.

Whether these investments are seen as smart strategy or potential warning signs will depend on how AI adoption unfolds in the coming years.

For now, Jensen Huang is standing firm — rejecting the circular deal narrative and doubling down on Nvidia’s belief that it is helping build the future of computing.