Nvidia Surpasses Microsoft to Become World’s Most Valuable Company in 2025

Nvidia overtakes Microsoft as the world’s most valuable company in 2025, driven by surging AI demand and booming chip sales. Discover what’s fueling Nvidia’s rise and what it means for tech investors.

Chipmaker Nvidia overtakes Microsoft in market capitalization, fueled by surging demand for AI technology and investor confidence in its data center business.

In a landmark moment for the global tech industry, Nvidia has surpassed Microsoft to become the world’s most valuable publicly traded company, driven by explosive growth in artificial intelligence (AI) demand and record gains in its share price.

Nvidia’s Meteoric Rise: How the AI Boom Reshaped Market Dynamics

Nvidia’s market capitalization soared past $3.3 trillion on Tuesday, overtaking Microsoft for the top spot, according to data from CNBC. The company’s stock surged more than 5% in intraday trading, as investors continued to bet heavily on Nvidia’s dominant position in AI infrastructure and semiconductor innovation.

The milestone caps an extraordinary year for Nvidia, whose graphics processing units (GPUs) have become the hardware foundation of generative AI, machine learning, and data analytics. The Santa Clara-based chipmaker has seen its shares rise over 150% in 2025 alone, outpacing rivals and cementing its reputation as the “arms dealer” of the modern AI revolution.

“Nvidia is benefitting from a transformational shift in computing,” said Dan Ives, managing director at Wedbush Securities, in an interview with CNBC. “AI is generating new billion-dollar opportunities, and Nvidia is at the center of this surge, outpacing even the biggest tech titans.”

Microsoft Dethroned: The Changing Leadership of Big Tech

The rise of Nvidia marks the first time a semiconductor company has eclipsed the likes of Microsoft and Apple for the world’s highest market valuation. Microsoft’s own fortunes have also reflected the AI wave through its investment in OpenAI and integration of AI features across its products. However, its share price has grown at a far slower pace compared to Nvidia’s.

“Microsoft has played a significant role in the AI ecosystem,” noted Gene Munster, managing partner at Deepwater Asset Management. “But Nvidia’s hardware is the enabler — without it, these AI models wouldn’t be possible at scale.”

As of Tuesday afternoon, Microsoft’s market capitalization settled just below $3.3 trillion, followed by Apple at $3.2 trillion. Amazon and Alphabet round out the world’s top five most valuable public companies.

The AI Gold Rush: What’s Fueling Nvidia’s Surge?

At the core of Nvidia’s dominance is its H100 and Blackwell class AI chips, which power everything from data centers to research labs. The generative AI boom — led by tools like OpenAI’s ChatGPT and Google’s Gemini — has placed unprecedented demand on Nvidia’s datacenter products.

In its latest quarterly report, Nvidia posted record revenue of $26 billion, up 262% year-over-year, with the data center segment accounting for over 85% of total sales.

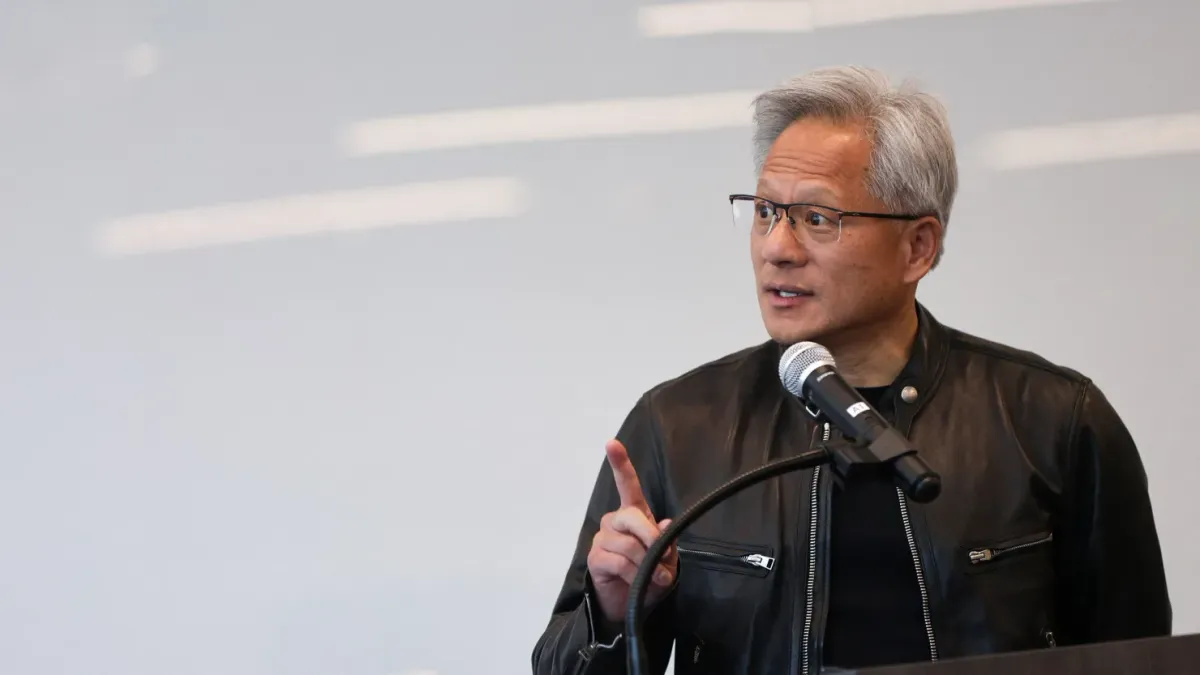

“In the last quarter, demand for our data center products has been simply extraordinary,” said Nvidia CEO Jensen Huang during an earnings call. “The entire industry is being reshaped by generative AI, accelerated computing, and high-performance networking.”

Enterprise leaders such as Amazon Web Services, Google Cloud, and Meta have signed billion-dollar contracts with Nvidia to secure AI hardware for their next-gen cloud platforms. Analysts estimate that Nvidia’s dominant market share in AI chips exceeds 80%.

The Broader Impact: What Does This Mean for Tech and Investors?

Nvidia’s ascendancy is being seen as a validation of Wall Street’s bullish bet on the AI sector, which is now expected to drive nearly all incremental tech growth in the decade ahead.

Yet, some experts caution that valuations are sky-high. “We’re in uncharted territory right now,” said Stacy Rasgon, senior analyst at Bernstein. “Nvidia’s fundamentals are stellar, but the expectations are baked in at extreme levels. Any disruption in the AI pipeline — or greater competition — could lead to sharp corrections.”

Other market participants note that Nvidia’s run-up is spurring broader investment into related sectors, including memory chips, networking, and data center cooling infrastructure. Rival chipmakers such as AMD and Intel have also seen share price gains, though not at Nvidia’s scale.

Skepticism and Competition: Can Nvidia Hold Its Crown?

With its new flagship chips and robust partnerships, Nvidia appears well-positioned to maintain its lead. However, looming threats remain from both established rivals and emerging competition from custom silicon designs at major hyperscalers.

“Amazon, Google, and others are designing more of their own chips,” said analyst Patrick Moorhead of Moor Insights & Strategy. “While Nvidia is top dog today, the cost and complexity of AI at scale might eventually drive more competition in hardware.”

Sources

CNBC: Nvidia overtakes Microsoft as world’s most valuable company

Recent Nvidia quarterly earnings calls (2025)

Expert commentary from Wedbush Securities, Deepwater Asset Management, and Bernstein

Market capitalization data from financial news trackers