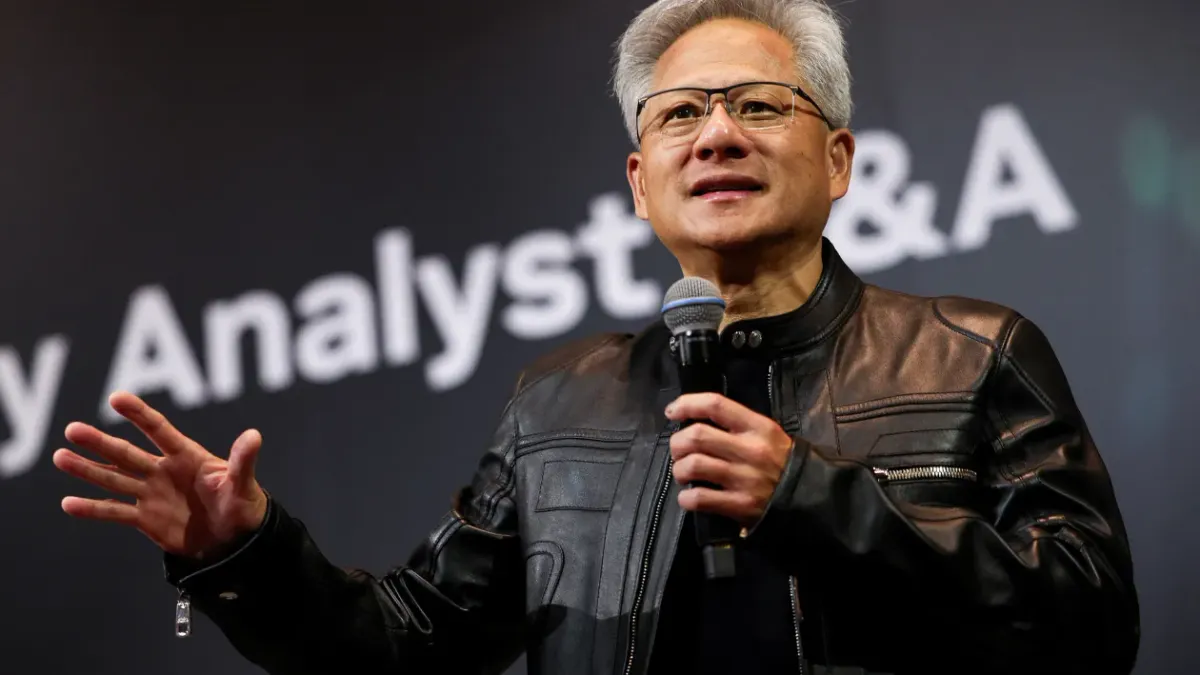

Nvidia CEO Jensen Huang Sells $12.94 Million Worth of Shares Amid Continued Growth and Strategic Developments

Nvidia CEO Jensen Huang has sold another 75,000 shares of the company worth about \$12.94 million, as per a fresh filing made with the U.S. Securities and Exchange Commission (SEC) on Friday. This is the latest sale in a prearranged trading plan that was instituted in March 2025, in which Huang can sell as much as 6 million Nvidia shares over a specified time frame.

Earlier during the week, Huang disposed of 225,000 shares, worth about $37 million in value. The large sales are in the context of Nvidia's ongoing dominance in the artificial intelligence market where its powerful GPUs are in high demand. These chips are essential to fueling big language models and AI applications across industries.

Jensen Huang, who co-founded Nvidia in 1993, has seen his net worth skyrocket alongside the company's meteoric rise. As of mid-2025, Nvidia has become the most valuable publicly traded company in the world, surpassing a $4 trillion market capitalization milestone. This explosive growth is largely driven by the global AI boom, which has accelerated investments in computing infrastructure and demand for Nvidia’s proprietary chip technology.

This week's news was not confined to stock deals. Nvidia also revealed that it plans to restart sales of its H20 AI chips to China. This follows positive indications from the Trump administration, which has said it will issue the necessary export licenses. These chips were initially under export bans by U.S. authorities earlier this year, citing national security concerns. The H20 chips were specifically designed to meet U.S. regulatory thresholds while still being useful for Chinese customers.

Nvidia confirmed this in a press release: "The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon." In remarks in Beijing earlier this week, Huang outlined Nvidia's plans to sell more advanced chipsets in China later on, indicating continued ambitions to be a competitive player in the global AI hardware competition despite geopolitical headwinds.

Since Nvidia continues to solidify its lead in AI innovation, it is probably part of long-term financial planning and diversifying assets, typical among senior executives.

Frequently Asked Questions (FAQs)

Why is Jensen Huang selling Nvidia shares now?

Jensen Huang's sales of shares are in the context of a predetermined strategy implemented in March 2025 to sell up to 6 million shares. Executives tend to use such plans to keep the company from being accused of insider trading and to manage their fortunes strategically.

Does the sale of stock indicate Nvidia's growth is decelerating?

No, the sale of stock does not represent slowing growth. Nvidia is still one of the globe's fastest-growing firms, currently worth more than \$4 trillion. The sales of shares are less about corporate performance and more about managing personal finances.

What is the H20 chip, and why is it significant to China?

The H20 chip is an AI-oriented graphics processing unit that is specifically built to meet U.S. export controls while filling the demand of Chinese technology companies. Its comeback as a resumption of sales indicates Nvidia's flexibility in dealing with global trade regulations.

What has the U.S. government said in reaction to Nvidia's exporting intentions?

The Trump administration said it would grant licenses for Nvidia to continue H20 chip sales to China. This is a dramatic policy reversal from the earlier part of the year when such exports needed very tight permissions.

What are the implications for Nvidia's future?

With high demand for AI chips, international sales back on track, and ongoing innovation under the guidance of Huang, Nvidia is poised to hold its leadership position in the AI and semiconductor space in the near future.