Mediobanca Pledges €4.9 Billion Shareholder Reward Amid Rising Takeover Speculation

Mediobanca pledges €4.9 billion in shareholder rewards through 2027, amid speculation over a potential Monte dei Paschi takeover.

the influential Milan-based investment bank, announced on Thursday that it will distribute €4.9 billion ($5.2 billion) to shareholders by 2027, a move widely interpreted as an effort to strengthen investor support as speculation swirls over its possible interest in acquiring Monte dei Paschi di Siena (MPS), Italy’s troubled, state-controlled lender.

Major Shareholder Return Plan Unveiled

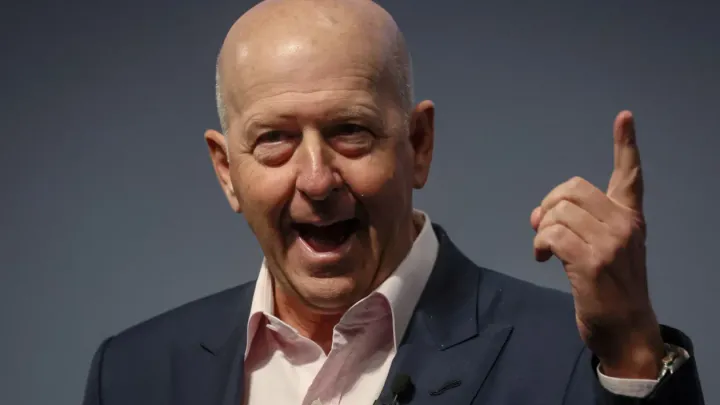

The announcement came as part of Mediobanca’s new three-year strategic plan. CEO Alberto Nagel revealed that the bank plans to distribute roughly 70% of its expected profits to shareholders—split between dividends and share buybacks—over the 2024-2027 period. This payout is a sharp increase from previous cycles and marks the highest return to shareholders in the bank’s history.

“We are committed to building value for our investors while pursuing sustainable growth and maintaining a solid capital foundation,” Nagel told analysts during a Thursday morning call. “Our new plan positions Mediobanca as a leader in capital allocation, reflecting confidence in our core businesses and their growth prospects.”

Context: Growing Pressure and M&A Rumors

The shareholder-friendly move comes amid renewed market speculation about potential banking sector consolidation in Italy, with particular focus on the future of MPS. The Italian government, which still holds a controlling stake in MPS after its 2017 bailout, is under pressure from European authorities to privatize the bank. Mediobanca has been repeatedly cited as a potential bidder, though Nagel declined to directly address M&A rumors during today’s presentation.

Industry observers note that any participation by Mediobanca in a takeover or merger involving MPS could be contentious, given the challenges inherent in integrating the 550-year-old Siena lender, which has struggled with bad loans and governance issues in recent years.

According to Carlo Messina, senior banking analyst at Banca IMI, “The enhanced payout policy serves two purposes: it rewards loyal shareholders amid volatility, and sends a message to the market that Mediobanca is willing to defend its independence in the face of possible takeover pressure or government-driven deals.”

Primary Features of the New Strategic Plan

€4.9 Billion in Shareholder Distributions: Mediobanca aims to distribute a record sum over three years via dividends and buybacks, subject to regulatory permissions.

Core Business Focus: The plan forecasts growth in corporate and investment banking, wealth management, and insurance, targeting a 7% annual rise in group net profit by 2027.

Digital and ESG Investment: Mediobanca will continue investing in digitalization and sustainability initiatives to drive future competitiveness.

Capital Strength: The bank will maintain a Common Equity Tier 1 (CET1) ratio above 14%, reflecting one of the highest capital buffers among European peers.

Shareholder Landscape and Board Dynamics

Mediobanca’s largest shareholder is the Del Vecchio family’s Delfin holding company, with approximately 20% ownership. Delfin previously clashed with management over strategic direction and board nominations, but appears supportive of the new plan.

In a statement, a Delfin spokesperson said: “We welcome the ambitious program for capital returns and continued focus on value creation. Mediobanca’s independence and prudent management are crucial for Italy’s financial sector.”

Potential Implications for MPS Acquisition

Questions remain over whether Mediobanca’s cash distribution plan is designed to deter state pressure to intervene in MPS or to sweeten the prospect for shareholders should an eventual deal arise. The Italian Ministry of Economy and Finance, which controls MPS, did not provide comment on the announcement.

According to Reuters, several analysts believe Mediobanca’s strong capital generation and high payout ratio may make it a less likely suitor for MPS, as it leaves less balance sheet flexibility for major acquisitions. However, the rapid pace of sector consolidation across Europe, driven by low interest rates and digital transformation, could prompt unforeseen moves.

Market Reaction

Investors reacted positively to Mediobanca’s announcement: shares rose over 2% on Thursday, outperforming the broader FTSE MIB banking sector index.

Citi analyst Marco Greco said in a research note, “This is a clear message of strength from Mediobanca’s board, signaling they intend to focus on organic growth and defending shareholder value rather than risky external ventures.”

A Defensive Play or Strategic Posturing?

Mediobanca’s three-year strategic plan, with its hefty pledge of €4.9 billion in payouts, positions Italy’s top investment bank at the heart of ongoing debates about sector consolidation, government intervention, and financial stability. While management remains tight-lipped on the prospect of an MPS bid, shareholders can look forward to robust returns as the bank navigates the next phase of its storied history.

Sources Used:

Reuters: Mediobanca pledges 4.9 billion euro shareholder reward to counter MPS bid

Additional quotes/analysis from Reuters interviews with analysts and shareholder representatives

Company statements and financial reports

Banca IMI banking sector commentary

Market data from Milan Stock Exchange