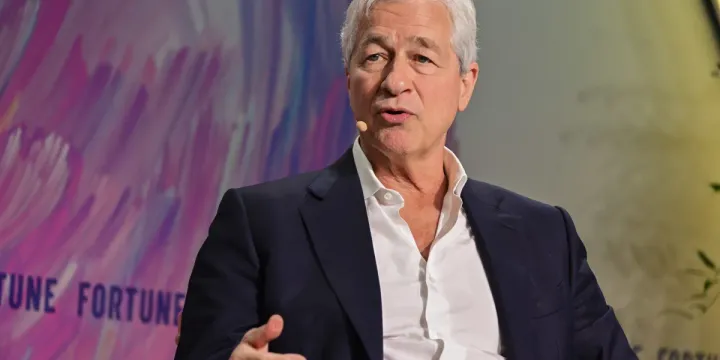

Jamie Dimon Wants to Fix the Economy by Doubling Tax Credits for Working Americans

JPMorgan CEO Jamie Dimon Proposes Doubling Tax Credits to Support Working Americans

At the World Economic Forum in Davos, JPMorgan CEO Jamie Dimon highlighted the growing economic divide in the United States and proposed a bold solution: increasing income tax credits for working Americans. He suggested that more money should be put directly into the hands of those who need it most, even if it requires higher taxes on the wealthy.

Dimon emphasized that simply sending money to Washington often fails to reach the people who need it, while direct tax credits could empower individuals to spend, invest, and support their communities.

Understanding the K-Shaped Economy

The U.S. economy is increasingly unequal, with wealthy households thriving while many lower-income Americans face stagnation. Upper-income earners benefit from rising stock markets and property values, while lower-income workers struggle with limited savings and fewer job opportunities.

This widening gap, often referred to as a K-shaped economy, shows two diverging paths. One group continues to accumulate wealth, while the other faces declining purchasing power and economic insecurity.

Directly boosting income tax credits for working Americans could help close this gap, providing financial relief where it is most needed. Such measures would allow families to cover essential expenses, save for emergencies, and support local businesses.

Funding the Tax Credit Expansion

Implementing higher income tax credits raises an important question: how will it be funded? The U.S. federal government already faces a significant deficit. In the fiscal year 2025, government spending totaled around $7 trillion, while revenue collection amounted to just over $5 trillion, creating a deficit of nearly $1.8 trillion.

The national debt now exceeds $38 trillion, and interest payments alone recently totaled more than $276 billion over three months. Given these numbers, funding a direct transfer program would be challenging, but proponents argue that the economic benefits of increased consumer spending could offset some of the cost.

By putting money directly into the hands of people likely to spend it quickly, the economy could experience a multiplier effect. This could lead to stronger retail activity, more support for small businesses, and improved economic stability at the local level.

Why Direct Tax Credits Could Be More Effective

Traditional government spending and broad tax cuts often fail to reach the people who need financial support most. Direct tax credits, on the other hand, would give working Americans the ability to spend on essentials or invest in their futures.

This approach could also simplify the current system, which often includes eligibility requirements such as having children or meeting complex income criteria. Removing these conditions ensures the funds reach all working individuals, not just select groups, making the system more equitable and efficient.

Impact on Families and Communities

Increasing income tax credits could have significant effects on families and communities across the country. More disposable income would help families cover basic needs, save for emergencies, or invest in education and skill development.

At the community level, increased spending would support local businesses and stimulate economic activity. For struggling households, this could mean the difference between making ends meet and falling further into financial hardship.

Such targeted financial support also has the potential to strengthen the social fabric, reduce economic stress, and promote upward mobility for those traditionally left behind by economic growth.

Addressing Wealth Inequality

Dimon’s proposal also targets wealth inequality by redirecting funds from higher-income earners to those at the lower end of the economic spectrum. Unlike blanket tax cuts for corporations or the wealthy, which tend to disproportionately benefit the rich, direct tax credits prioritize those who need financial support to maintain a basic standard of living.

By narrowing the gap between rich and poor, the economy can become more resilient. Supporting the lower-income population not only addresses fairness but also increases overall consumer demand, which drives long-term economic growth.

Challenges to Implementation

While the idea of expanding tax credits is appealing, there are real challenges to implementation. The federal deficit is already high, and raising taxes on wealthy individuals or corporations is often politically contentious.

Additionally, distributing funds efficiently requires a system that ensures direct payments reach recipients without excessive bureaucracy or administrative delays. Lawmakers would need to balance the economic benefits of such a program against the potential fiscal strain it could place on the federal budget.

Despite these challenges, supporters argue that direct support for working Americans could be one of the most effective ways to stimulate the economy and address income inequality simultaneously.

Historical Context of Tax Credits

Income tax credits have long been used as a tool to reduce poverty and promote economic mobility in the United States. Programs like the Earned Income Tax Credit (EITC) have helped millions of households, particularly those with children, increase their disposable income.

Expanding tax credits to cover all working adults, regardless of family status, represents a modern approach to the same goal. By giving individuals more flexibility and autonomy over their finances, the policy could support broader participation in the economy and reduce financial stress for a significant portion of the population.

Economic Benefits of Targeted Relief

Direct financial support through tax credits can stimulate the economy in multiple ways:

- Increased consumer spending leads to higher demand for goods and services.

- Boosted local businesses helps sustain jobs and encourage entrepreneurship.

- Higher savings rates provide a safety net for families, improving financial stability.

This approach also addresses structural economic problems, such as stagnant wages and underemployment, by putting resources directly into the hands of people who are most likely to spend them.

The Broader Vision

Dimon’s focus on income tax credits reflects a broader economic philosophy: empowering people at the bottom of the economic ladder can drive systemic growth. Instead of relying on trickle-down effects from corporations or government spending programs that may not reach those in need, direct financial support ensures that economic gains benefit a wider population.

Such measures could help reduce the widening gap between rich and poor, improve economic resilience, and promote a healthier, more balanced society.

Expanding income tax credits for working Americans represents a practical, people-first approach to economic policy. While funding challenges and political obstacles exist, the potential benefits are significant.

By putting money directly into the hands of those who need it most, the economy can see immediate boosts in spending, stronger communities, and improved financial security for millions of households. In an era of growing economic inequality, targeted tax credits could offer a meaningful path to fairness and prosperity for all Americans.