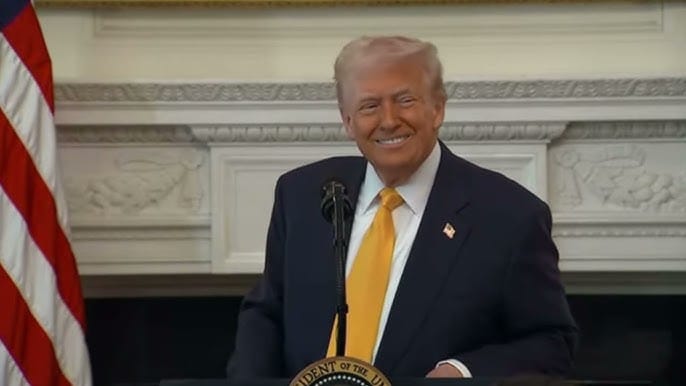

Investors Panic as Trump’s Greenland Plan Sends Markets Tumbling

Markets in Turmoil: Investors React to Trump’s Greenland Plan

Investors around the world reacted sharply after President Trump insisted he would push forward with his controversial plan to take over Greenland. The announcement sent shockwaves through global markets, with the S&P 500 falling 2%, despite a strong quarter in which more than 80% of its companies beat earnings expectations.

The U.S. dollar weakened nearly 1% against a basket of foreign currencies, signaling a decline in investor confidence. Safe-haven gold surged to a new record high, while U.S. bond prices experienced modest declines. Traders referred to the situation as a “sell America” trade, reflecting concerns that U.S. assets may no longer be considered the safest place for investment.

Global Investors Consider Diversifying Away from the U.S.

The Greenland plan has sparked discussions about reducing reliance on U.S. assets. Analysts and economists are increasingly debating whether investors should hedge against potential risks by allocating capital to more stable markets.

Data from the start of 2026 shows a notable trend: the S&P 500 is down 0.71% year-to-date, while European markets are rising, with the STOXX 600 up 0.69% and South Korea’s KOSPI surging 14%. Comparisons like these are encouraging investors to consider international diversification more seriously than ever before.

Historical Context of U.S. Primacy

Some analysts argue that the U.S. dollar’s dominance as a global reserve currency is linked to America’s historical geopolitical influence. Whenever the U.S. faces major political or military upheavals, financial markets tend to experience turbulence.

Examples often cited include the aftermath of the Vietnam War, the depletion of U.S. gold reserves, and the collapse of the Bretton Woods system in the 1970s. These periods coincided with declining real value of the dollar, rising inflation, and economic stagnation, showing how political instability can directly affect financial markets.

Today, concerns about U.S. political actions—like the Greenland plan—are renewing debates over the dollar’s long-term stability and the possibility of global investors seeking alternatives to U.S. assets.

Europe’s Role as a Major Lender

European countries hold significant stakes in U.S. debt and equities, giving them leverage in global markets. Analysts point out that the $8 trillion in U.S. bonds and equities owned by European investors nearly doubles the combined holdings of all other regions.

This heavy exposure means that political actions from Washington could trigger capital reallocation. Already, some European investors, such as Denmark’s AkademikerPension, have moved to reduce their U.S. bond exposure, selling stakes totaling $100 million.

While full-scale capital flight has not yet occurred, even the discussion of it is causing ripples in the financial system, affecting investor sentiment and market behavior.

Market Reactions

Financial markets have shown immediate responses to Trump’s Greenland plan:

- S&P 500 futures were slightly up at 0.19% this morning, following a 2% drop in the previous session.

- STOXX Europe 600 was down 0.4% in early trading.

- The FTSE 100 in the U.K. remained flat.

- Japan’s Nikkei 225 slipped 0.41%.

- China’s CSI 300 held steady.

- South Korea’s KOSPI rose 0.49%.

- India’s Nifty 50 fell 0.3%.

- Bitcoin declined to $89,000.

This snapshot illustrates the global nature of the reaction, affecting equities, bonds, and even digital assets.

The Potential for a Global “Sell America” Trend

Financial strategists are considering the broader implications of U.S. political instability. If investor confidence in U.S. assets diminishes, several outcomes could follow:

- Reduced demand for U.S. debt, potentially raising interest rates.

- Capital outflows from U.S. equities, affecting corporate investment and stock prices.

- Strengthened alternative markets, including Europe, Asia, and safe-haven commodities like gold.

While large-scale moves have yet to materialize, the mere possibility has investors rethinking long-term strategies and global asset allocation.

Tariffs and Economic Retaliation

Beyond Greenland, trade tensions add another layer of risk. Analysts note that the U.S. relies heavily on foreign investment to fund deficits, leaving it vulnerable to retaliation if political or economic policies disrupt international trust.

Europe possesses tools, such as the Anti-Coercion Instrument, which can restrict U.S. service exports. In 2024, U.S. services exports to the EU amounted to $295 billion, roughly 0.9% of U.S. GDP. While relatively small in scale, the EU could still exert pressure on the U.S. economy through targeted economic measures, including limiting access to European markets.

Long-Term Implications for the Dollar

If investor confidence continues to erode, the U.S. dollar’s status as the global reserve currency could be at risk. Economists highlight that the dollar’s stability has historically depended on the U.S. role as a global guarantor of security and economic order.

Events that disrupt these roles can lead to capital reallocations, increased demand for alternative currencies, and a rise in safe-haven assets like gold. Some analysts warn that prolonged uncertainty could eventually shift global reserve holdings away from the dollar, reducing its influence in international finance.

Lessons from Recent History

Even minor shifts in confidence can have dramatic effects. For instance, European investors have previously repatriated funds during periods of geopolitical uncertainty, demonstrating how quickly global capital can move. While full-scale market exits have yet to occur, these trends underscore the importance of geopolitical stability for financial markets.

Investors are closely watching the interplay between political decisions, trade policies, and global economic balance, knowing that minor disruptions can cascade into larger financial consequences.

Investors Weigh Alternatives

As the situation develops, many institutional investors are exploring ways to diversify away from U.S. exposure:

- Expanding portfolios in Asia and Europe.

- Increasing holdings in gold and other commodities.

- Considering other fiat currencies as reserve assets.

The underlying message is clear: in a world of rising political uncertainty, the traditional assumption that the U.S. is the safest investment hub may no longer hold true.

What’s Next for the Markets

Investors are waiting for President Trump’s speech at the World Economic Forum in Davos for further guidance. Markets are likely to remain volatile, reflecting ongoing uncertainty.

Even minor signals from policymakers or global leaders could trigger sharp reactions, highlighting how sensitive global markets have become to political news. Traders, fund managers, and analysts alike are preparing for the possibility that the Greenland situation could reshape global investment patterns.

The Greenland controversy has reignited global debates over U.S. financial dominance and the stability of the dollar. Markets have responded with caution, reflecting concerns over political risk, trade tensions, and potential capital outflows.

While no full-scale market flight has occurred, the discussion itself signals a new era of heightened vigilance among investors. With global capital increasingly mobile, even speculative political moves can have far-reaching economic consequences.

The coming weeks will reveal whether this situation represents a temporary shock or the beginning of a broader reallocation of global investments away from the U.S., reshaping financial markets in 2026 and beyond.