FX Traders Brace for Volatility as U.S. Election Results Loom

With the 2024 U.S. election results hanging in the balance, FX traders are bracing for volatility. Euro and Mexican peso options volatility spike as market uncertainty grows over the Trump vs. Harris showdown.

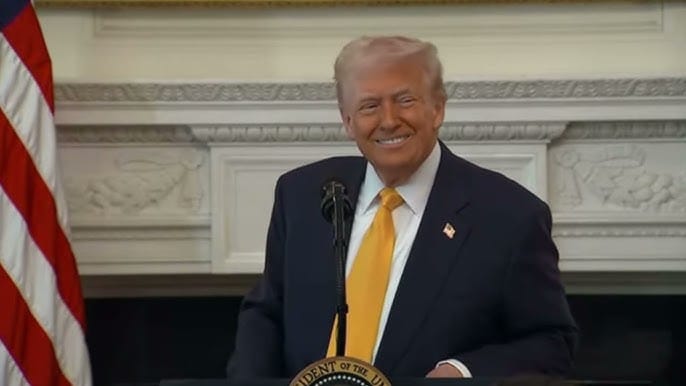

As the highly anticipated 2024 U.S. presidential election unfolds, FX traders are bracing for significant market turbulence, with currency volatility spiking as the results remain uncertain. Currency options trading for the euro and Mexican peso has surged to levels not seen since the tumultuous 2016 U.S. election, driven by the intense market uncertainty surrounding the tight race between Democratic Vice President Kamala Harris and Republican former President Donald Trump.

Both candidates remain neck-and-neck in national opinion polls, and market participants are preparing for the possibility that the winner may not be determined for days after the election. Given the stakes, traders are scrambling to hedge against significant price swings, especially in currencies like the euro and the peso, which are seen as particularly sensitive to the outcome.

The Market’s Focus: The Euro and Mexican Peso

The euro, one of the most traded currencies in the world, is experiencing a sharp rise in implied volatility. On Election Day, overnight implied volatility for the euro surged to 26.4%, the highest level since November 9, 2016, when Donald Trump unexpectedly won the presidential race. This spike reflects growing concerns over potential market-moving developments as the results of the 2024 election come in.

Similarly, the Mexican peso is also seeing volatility soar, with overnight implied volatility hitting a staggering 87%, its highest level since the 2016 election. The peso, closely tied to U.S.-Mexico trade relations, is expected to be highly sensitive to Trump's policies on tariffs and immigration, which could have a significant impact on Mexico's economy.

“Today's election is closer than a coin toss, highlighting the uncertainty surrounding the outcome,” said Monex Europe strategists in a recent note. "This uncertainty is likely to keep market price action subdued, as traders await results in the early hours of tomorrow morning."

What to Expect in the Coming Weeks

As traders look ahead, they’re not expecting volatility to dissipate anytime soon. One-week implied volatility for the euro hit 13.06%, the highest since the market turbulence caused by the collapse of Credit Suisse in March 2023. One-month volatility for the euro remains elevated as well, reflecting continued nervousness around the U.S. election results.

For the Mexican peso, one-week implied volatility has surged to 44%, its highest level since the onset of the COVID-19 pandemic in March 2020, and nearly four times the volatility seen during the 2020 U.S. election. The currency markets are clearly on edge, as the outcome of this year's election could significantly alter trade relationships and economic policies.

Trump vs. Harris: Market Implications

FX traders are particularly wary of the potential policy shifts under each candidate. Analysts believe that a Trump victory would likely trigger inflationary pressures, as his policies on immigration, tax cuts, and tariffs are expected to push up bond yields and strengthen the U.S. dollar. Conversely, Harris, seen as the continuity candidate, is likely to maintain the current economic trajectory, which may stabilize the markets to some extent.

The potential for increased trade tensions, particularly between the U.S. and China, could also fuel volatility. Trump’s hardline stance on tariffs and trade is well known, and his re-election could lead to even more punitive measures against China and other global trade partners. This could impact not just the U.S. dollar but also the currencies of major trading partners, including the euro and Canadian dollar.

Rising Volatility for Global Currencies

The FX market's nerves aren’t confined to the euro and Mexican peso alone. The offshore Chinese yuan, which plays a crucial role in the global economy, is also seeing a sharp rise in implied volatility. On Tuesday, one-week implied volatility for the yuan spiked to 14.45%, its highest level since at least 2012, according to LSEG data.

Other key currencies are experiencing similar volatility. The Canadian dollar, for instance, saw one-week options top 8.5%, the highest since March 2023. The rise in implied volatility relative to realized volatility highlights just how jittery the market is in the face of an uncertain election outcome.

"Rising implied volatility for the euro and Canadian dollar reflects the market’s nervousness about a Trump victory, which could lead to broad-based tariffs impacting open economies like the eurozone and Canada,” said Chris Turner, strategist at ING. “A Trump 2.0 administration is likely to pursue aggressive trade policies that would impact major global currencies.”

What Traders Should Expect

As the U.S. election results continue to unfold, FX traders will be closely monitoring both immediate price movements and longer-term trends. Volatility is expected to remain elevated in the coming days and weeks, particularly as the full implications of the election’s outcome become clearer. Traders are preparing for a range of potential outcomes, from trade policy shifts to changes in inflation expectations, and are taking steps to hedge their positions accordingly.

For now, market participants are watching every twist and turn of the election closely, as they prepare for what could be a turbulent period for the global FX market.