From Billionaire to Trillionaire? Why SpaceX’s Possible IPO Has Everyone Watching Elon Musk

Elon Musk has never been far from headlines, but 2026 could mark an entirely new chapter in his financial story. After the blockbuster merger between SpaceX and artificial intelligence company xAI, Musk’s net worth has reportedly surged past 800 billion dollars. Now, speculation is intensifying about whether he could become the world’s first trillionaire, especially with rumors of a SpaceX public offering expected sometime in mid-2026.

Investors, analysts, and even prediction markets are closely tracking this possibility. Some forecasts suggest there is a strong chance Musk could cross the trillion-dollar mark before 2027. While that might sound extraordinary, a combination of SpaceX growth, AI integration, and Tesla incentives could make it more realistic than ever.

Here’s a simplified and engaging look at what’s driving the speculation and what it could mean.

Why the SpaceX IPO is attracting so much attention

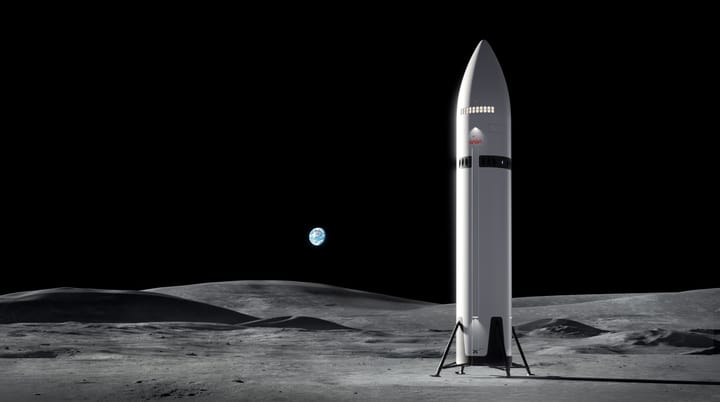

SpaceX has evolved from a risky space startup into one of the most influential private aerospace companies in the world. Its achievements include reusable rockets, satellite internet expansion through Starlink, and ambitious deep-space exploration plans.

Following the merger with xAI, SpaceX’s estimated valuation has climbed to around 1 trillion dollars. Analysts believe that if the company launches an initial public offering, the valuation could climb even higher — potentially around 1.5 trillion dollars.

Several factors are fueling that optimism:

Dominance in satellite internet

Starlink has rapidly expanded global broadband coverage, especially in remote regions. Its growing customer base and recurring subscription revenue make it attractive to investors.

Advances in reusable rocket technology

Frequent rocket launches and improved cost efficiency have strengthened SpaceX’s competitive advantage in the commercial space sector.

Starship development

The company’s next-generation spacecraft is designed for deep-space missions and heavy cargo transport, which could unlock new revenue streams.

Artificial intelligence integration

The merger with xAI suggests future synergies between AI technology and space operations, satellite data analysis, and automation.

These developments have positioned SpaceX as not just a space company but a technology infrastructure powerhouse.

How a public offering could make Musk a trillionaire

Elon Musk reportedly owns about 42 percent of SpaceX. If the company goes public at a valuation close to 1.5 trillion dollars, his stake alone could exceed 600 billion dollars.

When combined with his holdings in Tesla and other ventures, that could easily push his total wealth past the trillion-dollar threshold.

Prediction markets have taken notice. Some estimates suggest roughly a 72 percent probability that Musk becomes a trillionaire before 2027, while the likelihood of a SpaceX IPO before then is even higher.

While these predictions are not guarantees, they reflect strong investor confidence in both Musk’s companies and the broader technology sector.

Tesla’s pay package adds another layer

Even without a SpaceX IPO, Musk has another potential financial boost through his Tesla compensation package approved in 2025.

This performance-based package includes additional Tesla shares tied to ambitious milestones. Among them:

Tesla reaching an 8.5 trillion dollar valuation

Deployment of one million humanoid robots

Major expansion in autonomous driving and AI systems

If all conditions are met, the package could theoretically be worth close to 1 trillion dollars. That means Tesla alone could significantly contribute to Musk’s net worth growth.

This incentive structure reflects Tesla’s long-term focus on automation, robotics, and AI-driven transportation — industries expected to expand rapidly in the coming years.

Historical wealth comparisons: breaking old records

The idea of a trillionaire naturally raises comparisons with the richest figures in history.

John D. Rockefeller and the share-of-GDP benchmark

Oil magnate John D. Rockefeller remains a benchmark for economic influence. At his peak in the early 20th century, his fortune represented about 3 percent of US GDP.

Today, Musk’s estimated wealth already accounts for roughly 2.7 percent of US GDP. If he crosses the trillion-dollar mark, that share could exceed 3 percent, meaning his economic influence relative to the US economy would surpass Rockefeller’s historic peak.

This comparison highlights how concentrated wealth in modern technology sectors can rival even the industrial giants of the past.

Mansa Musa and inflation-adjusted wealth

Another frequently cited figure is Mansa Musa, the 14th-century emperor of Mali. His vast gold resources made him legendary for wealth, though precise estimates are impossible.

Some historians believe his riches were effectively unmatched because he controlled a large share of global gold supply.

If Musk’s wealth reaches trillion-dollar territory through publicly documented companies, it could represent one of the most clearly measured fortunes in history, even if comparisons across centuries remain complex.

Technology versus natural resources

One interesting difference between historic wealth and modern fortunes is the source of value.

Historical fortunes often came from land, oil, or precious metals. Today’s tech billionaires build wealth through innovation, intellectual property, and digital infrastructure.

Musk’s ventures combine several future-focused industries:

Space exploration and satellite networks

Artificial intelligence development

Electric vehicles and renewable energy

Robotics and automation

These sectors are expected to shape the global economy for decades, which partly explains the intense investor enthusiasm.

Potential risks and uncertainties

Despite the optimism, several factors could influence whether Musk actually reaches trillionaire status.

Market volatility

Public markets can shift quickly. A lower-than-expected IPO valuation could delay the milestone.

Regulatory challenges

Space, AI, and autonomous technologies all face increasing regulatory scrutiny worldwide.

Execution risks

Large-scale projects like Starship development or Tesla robotics programs require significant technical success.

Competition

Other technology companies are rapidly investing in AI, space infrastructure, and electric vehicles.

While Musk has a track record of overcoming challenges, these uncertainties remain part of the equation.

Why investors are watching closely

The potential SpaceX IPO is not just about Musk’s personal wealth. It also represents a broader moment for technology investing.

If SpaceX achieves a valuation above 1 trillion dollars, it could:

Boost confidence in private space companies

Accelerate investment in satellite communications

Increase funding for AI-integrated infrastructure

Drive competition across aerospace and tech industries

Investors often view such milestones as signals of where future economic growth may occur.

The bigger picture: the rise of trillion-dollar entrepreneurs

The possibility of a trillionaire reflects how rapidly technology-driven wealth can grow in the modern economy.

Several trends contribute to this shift:

Global digital markets scale quickly

Software and AI enable exponential productivity

Infrastructure like satellites and electric vehicles create recurring revenue

Private capital markets support massive innovation funding

Musk’s companies sit at the intersection of these trends, which is why analysts consider his trillionaire status plausible rather than purely speculative.

Elon Musk’s financial trajectory continues to capture global attention. With SpaceX potentially heading toward a major public offering and Tesla offering performance-based incentives worth billions, the path to becoming the world’s first trillionaire appears increasingly possible.

Whether it happens soon or takes longer, the underlying story is about more than personal wealth. It reflects the growing influence of artificial intelligence, space technology, renewable energy, and automation in shaping the future economy.

As 2026 unfolds, the world will be watching not only Musk’s net worth but also how his companies continue to redefine industries once thought impossible to disrupt.