Facing a $7 Billion Tax Bill, Nvidia’s Jensen Huang Says He’s Perfectly Fine

Jensen Huang’s Calm Response to a Billionaires Tax

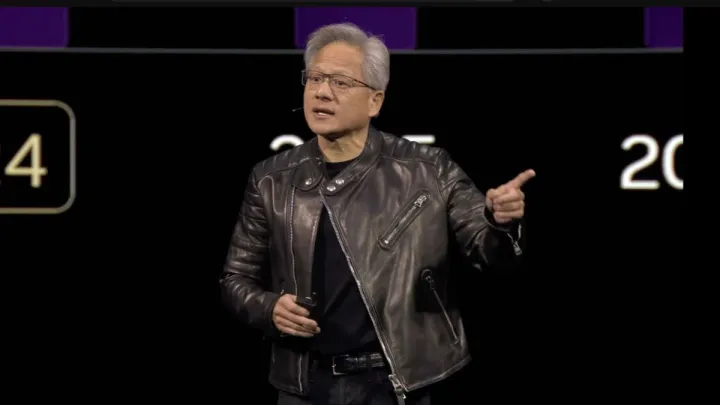

At a time when many of America’s wealthiest individuals are anxiously watching tax proposals and quietly changing their addresses, Nvidia CEO Jensen Huang is taking a very different stance. The man who leads the world’s most valuable company and ranks among the richest people on the planet says he is not worried at all about California’s proposed billionaires tax.

Speaking in a recent television interview, Huang made it clear that the issue barely registers for him. He said he chose to live in Silicon Valley and accepts whatever taxes come with that decision. His message was simple and unusually calm for someone who could face a multibillion-dollar tax bill.

While others are packing up and leaving the state, Huang appears content to stay put and focus on building the future of artificial intelligence.

What the Proposed Billionaires Tax Is About

A One-Time Levy on Extreme Wealth

The proposal under discussion in California would introduce a one-time 5% tax on billionaires who are residents of the state as of January 1. The funds raised would be used to cover shortages in areas such as healthcare, food assistance programs, and education.

The measure is still in its early stages. Supporters must gather enough signatures for it to appear on the November 2026 ballot. If it clears that hurdle and voters approve it, the tax would apply to a small group of ultra-wealthy residents.

Although the idea has sparked intense debate, it reflects growing pressure on states to address inequality and fund essential public services.

Why Jensen Huang Would Be Hit the Hardest

A $155 Billion Fortune

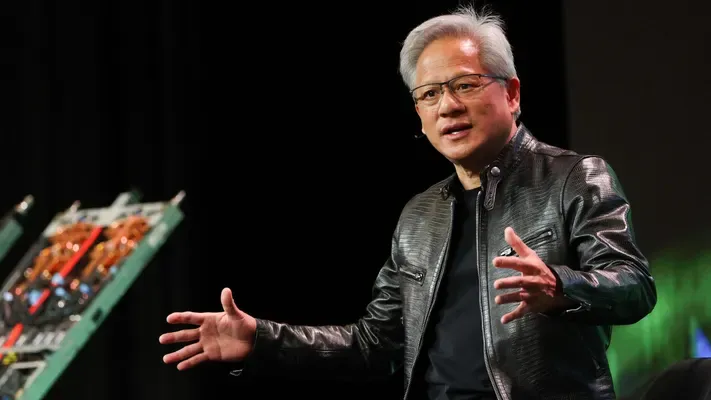

Jensen Huang is currently one of the wealthiest individuals in the world, with a net worth estimated at over $155 billion. That massive fortune is largely tied to Nvidia’s explosive growth as the backbone of the artificial intelligence revolution.

If the proposed tax were calculated based on his current wealth, Huang could face a bill exceeding $7 billion. For most people, even imagining such a number is overwhelming. Yet Huang speaks about it with remarkable indifference.

He has said plainly that he has not spent time worrying about the tax and does not plan to restructure his life around avoiding it.

Staying in Silicon Valley While Others Leave

A Growing Trend of Billionaires Moving Out

California has already seen a wave of high-profile departures by wealthy tech figures. In the days leading up to the residency cutoff, several billionaires publicly announced moves to states like Florida and Texas, where taxes are generally lower.

These moves are often framed as business decisions, but they also reflect concerns about rising taxes and regulatory pressure in California.

Despite this trend, Huang has chosen to stay. He has not hinted at relocating Nvidia’s headquarters or changing his residency. Instead, he emphasizes the importance of Silicon Valley as a hub for innovation.

Why Location Still Matters to Nvidia

According to Huang, Silicon Valley remains unmatched when it comes to talent. Engineers, researchers, and entrepreneurs from around the world continue to gravitate to the region.

For Nvidia, which builds the chips that power artificial intelligence systems, access to top talent is critical. Huang believes that being in the heart of the technology ecosystem outweighs the financial drawbacks of higher taxes.

In his view, success in AI depends more on people and ideas than on minimizing tax exposure.

From a Diner to a Tech Giant

Nvidia’s Humble Beginnings

Nvidia’s story is deeply tied to California. The company was founded in 1993 at a Denny’s restaurant in San Jose, a detail that has become part of Silicon Valley lore.

From those modest beginnings, Nvidia grew into a global powerhouse. Today, its chips are essential for training and running AI models used by some of the world’s biggest companies and research institutions.

The company is headquartered in Santa Clara, just a short drive from where it all began. For Huang, staying in California is not just a practical choice but also a personal one.

A Different Mindset About Wealth and Taxes

Accepting the Cost of Success

Huang’s comments stand out because they contrast sharply with the anxiety often expressed by wealthy individuals when taxes are discussed. Rather than framing the tax as unfair or punitive, he treats it as part of the cost of living and working in a place that enabled his success.

He has said that Silicon Valley gave him and Nvidia the opportunity to thrive. Paying taxes, even significant ones, is something he seems to view as a trade-off rather than a threat.

This attitude has earned attention not just because of the amount involved, but because it challenges the narrative that billionaires will always flee when taxes rise.

Focused on the Future of AI

Building, Not Worrying

When asked directly about the tax, Huang made it clear that his priorities lie elsewhere. He described himself as someone focused on building the future of artificial intelligence rather than worrying about policy debates.

Nvidia is currently at the center of a global AI boom. Its chips are in high demand, powering everything from large language models to industrial automation systems.

Huang’s leadership has turned Nvidia into one of the most influential companies of the modern tech era. His confidence suggests that, at least for him, long-term innovation matters more than short-term financial calculations.

What Huang’s Stance Signals to the Tech World

A Rare Voice of Calm

In an environment where many tech leaders are outspoken about regulation and taxation, Huang’s relaxed response is unusual. He does not dismiss the policy, attack lawmakers, or hint at leaving.

Instead, he signals stability. For employees, investors, and partners, this sends a message that Nvidia’s roots in Silicon Valley are firm.

It also adds nuance to the broader debate about taxes and innovation. Huang’s example suggests that high taxes do not automatically drive away all talent or ambition.

The Bigger Debate Still Ahead

Voters Will Have the Final Say

The proposed billionaire tax is far from becoming law. Voters will ultimately decide whether they support the idea and its goals.

If it passes, it could set a precedent not just for California, but for other states grappling with inequality and funding gaps. If it fails, it will still leave behind a conversation about who should pay for public goods in an era of extreme wealth concentration.

For now, Jensen Huang remains unconcerned. While others make headlines for leaving, he is staying put, building AI systems that may shape the global economy for decades to come.