Elon Musk’s SpaceX Plans Historic $50 Billion IPO at $1.5 Trillion Valuation

SpaceX Explores Mid-June IPO, Aiming for $50 Billion

Elon Musk’s SpaceX is reportedly considering an initial public offering (IPO) in mid-June 2026, targeting as much as $50 billion in fundraising and a valuation near $1.5 trillion, according to the Financial Times.

If completed, the IPO would become the largest in history by deal size, surpassing Saudi Aramco’s $29 billion IPO in 2019, which valued the company at $1.7 trillion.

SpaceX has not commented publicly, and Reuters could not immediately verify the report.

Why SpaceX May Be Going Public Now

Musk has long preferred to keep SpaceX private, but recent developments appear to be influencing a change in strategy:

- Growing Company Valuation: With SpaceX’s market value climbing steadily, a public listing could unlock significant capital.

- Starlink Success: The company’s satellite-internet service has proven highly successful, boosting investor confidence.

- Investor Interest: CFO Bret Johnsen has been in discussions with existing private investors since December 2025 to explore a mid-2026 IPO.

The IPO Could Be a Record-Breaking Event

The proposed $50 billion fundraising goal would make SpaceX’s IPO the largest in history, doubling prior estimates. For context:

- Saudi Aramco (2019): $29 billion IPO, $1.7 trillion valuation

- SpaceX (Potential 2026 IPO): $50 billion target, $1.5 trillion valuation

The IPO would attract global attention, with financial markets anticipating one of the most significant U.S. listings in years.

Wall Street Banks and IPO Preparation

SpaceX is reportedly lining up four leading Wall Street banks to manage the IPO. The process includes private discussions with existing investors and coordination to meet mid-June timelines.

Analysts note that the timing is strategic: U.S. equity markets are recovering after a slow 2022–2024 period marked by volatility and geopolitical tensions. Mega IPOs, particularly in high-growth technology sectors, are now regaining momentum.

A Hot Market for Space and Tech Stocks

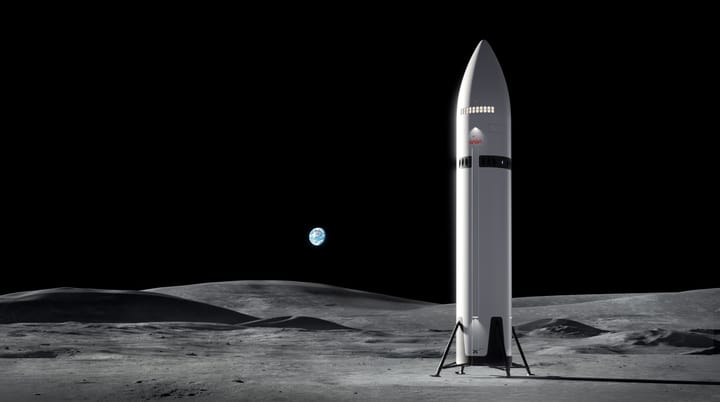

Space technology remains a highly sought-after sector, despite its traditionally private nature. Analysts say investors are drawn to the rapid innovation in satellite communications and aerospace, making SpaceX an attractive investment.

The SpaceX IPO also comes amid early IPO planning by other high-profile tech firms, including AI companies Anthropic and OpenAI, suggesting 2026 could be a banner year for mega listings.

What Investors Should Watch

- Valuation: $1.5 trillion would make SpaceX one of the most valuable companies ever to go public.

- Fundraising Goal: $50 billion in new capital, potentially the largest IPO ever by deal size.

- Sector Growth: Space technology and satellite services are rapidly expanding, driven by innovations like Starlink.

- Market Timing: The IPO is planned during a period of reviving U.S. equity market activity, potentially maximizing investor demand.

Bottom Line

SpaceX’s potential mid-2026 IPO represents a landmark event in both aerospace and financial markets. If Elon Musk proceeds with the plan, it could not only raise record-breaking funds but also reshape public investor access to space technology.

For investors, the IPO offers a rare opportunity to participate in one of the most innovative and high-profile private companies in the world.