China's Economic Shift: Ready to Ramp Up Debt to Offset U.S. Tariffs

China is preparing to deepen its debt and adopt more aggressive fiscal policies to counter the impact of U.S. tariffs, prioritizing growth over financial risks. Here's a look at the country's 2025 economic plans.

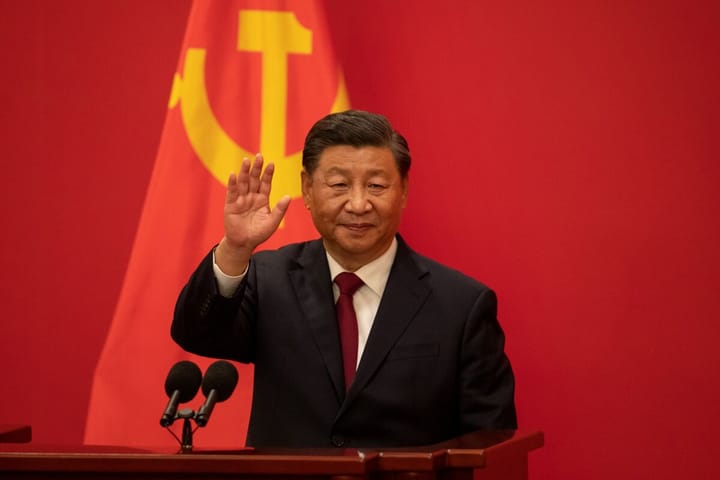

In a bold move to combat the economic challenges posed by rising U.S. trade tariffs, Chinese leaders have signaled a shift toward more aggressive monetary and fiscal policies. In one of their most dovish statements in over a decade, top Communist Party officials indicated that China is prepared to take on more debt and deploy stimulus measures to maintain its economic growth targets in 2025.

China Shifts to "Appropriately Loose" Economic Policies

At a key meeting this week, China’s Politburo, which is composed of the nation’s highest-ranking officials, announced that it would move away from its previous "prudent" stance on fiscal policy. Instead, they committed to an "appropriately loose" monetary policy, indicating an openness to more debt and spending to boost growth. This marks a significant shift, as China’s overall debt—including that of households, companies, and governments—has surged more than fivefold over the past 14 years, even as GDP has only tripled during the same period.

Shuang Ding, chief economist at Standard Chartered, emphasized the significance of the shift, describing the move from "prudent" to "moderately loose" as a major change, one that could leave plenty of room for further policy adjustments.

China's Growing Debt Burden: A Necessary Trade-off for Growth

As China grapples with slower economic growth and the looming threat of U.S. trade tariffs, the country has effectively "made peace" with the idea that its debt-to-GDP ratio will continue to rise. Experts like Christopher Beddor of Gavekal Dragonomics argue that this is no longer a constraint, as policymakers prioritize economic stability and growth over long-term debt sustainability.

This policy shift is expected to be a reaction to the tariffs imposed by the U.S., especially as President-elect Donald Trump prepares to return to office with threats of escalating tariffs of up to 60% on Chinese goods. While it’s still unclear how much monetary easing China’s central bank will implement, experts predict that China will take a proactive approach to counteract the economic fallout.

Fiscally Proactive: China’s 2025 Growth Plans Amid Rising U.S. Tariffs

With U.S. tariffs on the horizon, China’s leadership is taking steps to ensure that its economy remains resilient. According to Larry Hu, chief China economist at Macquarie, China is ready to do “whatever it takes” to meet its 2025 growth target. However, how much stimulus is needed will depend on the exact level of tariffs imposed and the global economic environment.

At the upcoming Central Economic Work Conference (CEWC), Chinese officials will discuss but not finalize growth and fiscal targets for 2025. Analysts suggest that China will aim for a growth target of around 5%, despite challenges in reaching this figure in 2024. This ambition suggests that Beijing is determined not to back down in the face of Trump’s tariff threats.

Increased Fiscal Deficit and Stimulus Measures Ahead

Experts predict that China will set a higher fiscal deficit target for 2025—possibly around 4%, up from 3% in 2024. This could lead to increased government spending, with additional stimulus measures, including special off-budget bonds or local government-issued bonds, to further support economic activity. The Chinese government is expected to assume more fiscal responsibility, especially as local governments struggle with high levels of debt.

The decision to push for a larger deficit is expected to result in an additional 1.3 trillion yuan ($179.4 billion) in stimulus, but China is likely to ramp up its efforts if economic conditions worsen. Some analysts believe that China may be willing to stretch its financial resources to avoid a significant economic slowdown, especially in light of trade tensions with the U.S.

Focus on Consumption as Key to Economic Recovery

One of the most notable shifts in China’s economic plan is an increased focus on boosting domestic consumption. The Politburo has promised "unconventional counter-cyclical adjustments" to stimulate consumption, which has been one of the weaker points of China’s economy in recent years. The country has struggled with low consumer demand, partly due to the prolonged property crisis and limited social welfare programs.

Experts predict that China’s 2025 economic recovery will be centered on consumption-driven growth, with a greater emphasis on high-tech manufacturing and risk containment rather than traditional investments in infrastructure and property. However, analysts like Julian Evans-Pritchard from Capital Economics caution that monetary easing alone may not be sufficient, as households and businesses are reluctant to take on more debt, even with lower interest rates.

The Road Ahead: How Will China Navigate the Challenges?

As China readies itself for the economic challenges posed by U.S. tariffs and rising debt levels, the next few years will be critical in determining whether these stimulus measures can sustain growth. Analysts are closely watching how Beijing manages its fiscal and monetary policies, especially in light of the growing risk of deflation and weak consumer demand.

China’s future economic strategy will need to balance the need for growth with the reality of its debt burden. By focusing on boosting consumption and fostering technological innovation, China hopes to reduce its reliance on debt and infrastructure investment, while navigating the ongoing tensions with the U.S. and the broader global economy.