China Set to Greenlight Nvidia H200 Chips: A Major Breakthrough for AI and the Global Chip War

China May Approve Nvidia H200 Chip Imports This Quarter, Opening a Key Market Again

China is preparing to approve the purchase of Nvidia’s H200 artificial intelligence chips as early as this quarter, according to people familiar with the matter. If confirmed, the move would mark a major shift for Nvidia, giving the US chipmaker renewed access to the world’s largest semiconductor market after years of restrictions.

While the approval is expected to come with strict limitations, it could still unlock billions of dollars in potential business for Nvidia and reshape competition in China’s fast-growing AI sector.

What Is Being Approved and What Is Not

Limited Green Light for Commercial Use

Chinese regulators are expected to allow local companies to buy Nvidia’s H200 chips for select commercial applications. The approval is still under discussion and has not been publicly announced, but officials are reportedly finalizing the details.

The H200 chips will be permitted only for non-sensitive uses. They will be barred from:

- Military applications

- Sensitive government departments

- Critical infrastructure

- State-owned enterprises

This approach mirrors China’s recent treatment of other foreign technologies, including devices from Apple and memory chips from Micron.

Case-by-Case Reviews Still Possible

If restricted entities request access to the H200 chips, their applications will not be automatically rejected. Instead, Chinese authorities may review such requests individually, leaving the door slightly open while maintaining strict oversight.

Even with these limits, the approval would represent a significant policy shift.

Why This Is a Big Win for Nvidia

Regaining Access to a Massive Market

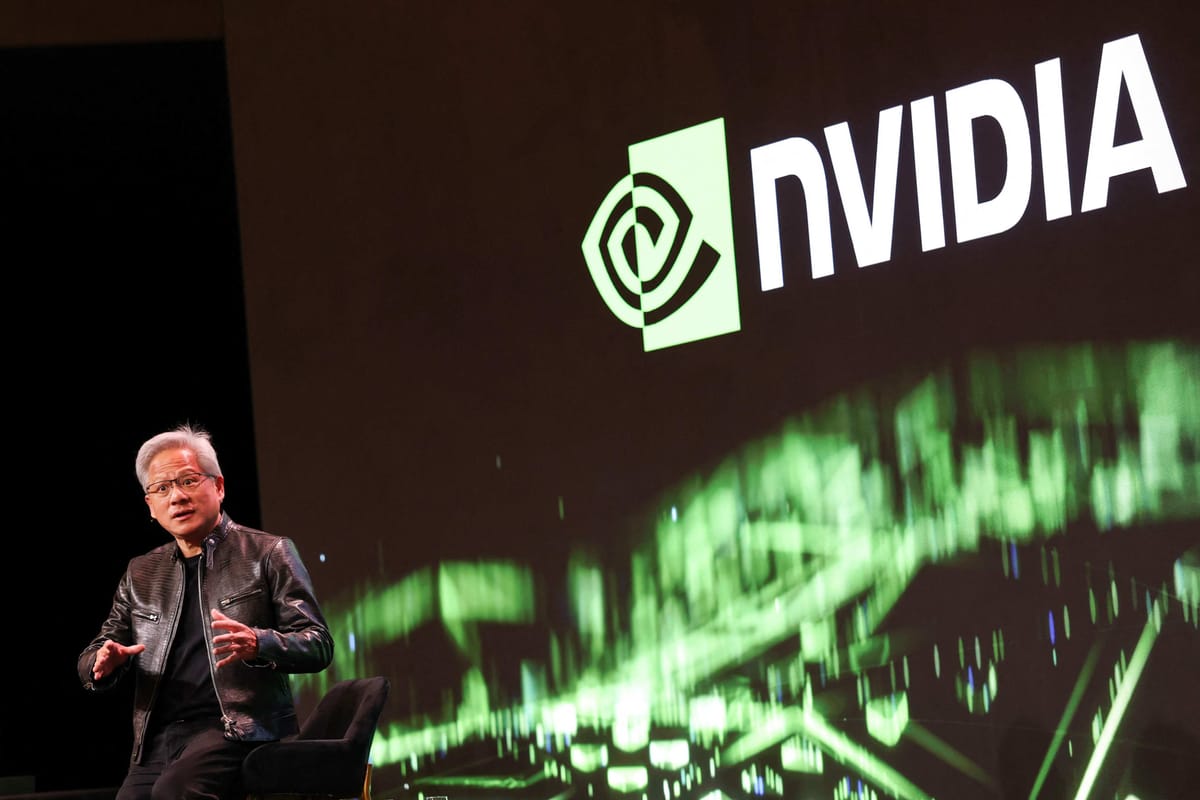

China is the world’s largest semiconductor market, and artificial intelligence chips are among its fastest-growing segments. Nvidia CEO Jensen Huang has said that the AI chip market in China alone could be worth $50 billion in the coming years.

Since US export restrictions tightened in 2022, Nvidia’s market share in China has fallen dramatically. Huang has previously stated that the company’s share dropped from as high as 95% to effectively zero.

Approval of the H200 would allow Nvidia to reclaim part of that lost ground.

Strong Demand Already Exists

Major Chinese tech companies are eager to buy the H200. According to people familiar with the discussions:

- Alibaba has expressed interest in ordering over 200,000 units

- ByteDance has indicated similar demand

Several fast-growing Chinese AI startups, including DeepSeek, are also looking to upgrade their models to compete with OpenAI and other US firms.

This pent-up demand explains why Nvidia’s stock edged higher in pre-market trading following reports of the possible approval.

What Is the Nvidia H200 Chip

Powerful, but Not Cutting-Edge

The H200 belongs to Nvidia’s Hopper generation of AI chips. While it is not Nvidia’s most advanced product, it remains highly capable.

Key context:

- Introduced in 2023

- Began shipping widely in 2024

- Older than Nvidia’s Blackwell line

- Two generations behind the upcoming Rubin series

The fact that the H200 lags the latest technology by roughly 18 months was a major reason the US government agreed to allow its export to China.

Why the US Allows H200 Exports

The US restricts the sale of Nvidia’s most advanced AI processors to China over national security concerns. However, the H200 was deemed less risky due to its age and performance gap compared to cutting-edge chips.

In early December, President Donald Trump reversed an earlier ban and approved shipments of the H200 to China, with one key condition: a 25% surcharge on exports.

This policy change cleared the US side of the equation. China’s approval is the final piece needed for sales to resume.

China’s Balancing Act: AI Ambitions vs Security Concerns

Push for Self-Sufficiency

China has made semiconductor independence a national priority. The government has pledged to mobilize resources to win the global technology race, especially in AI.

This includes:

- Preparing incentives of up to $70 billion for the chip sector

- Encouraging domestic alternatives to foreign chips

- Reducing reliance on US technology

Because of this strategy, Beijing has been cautious about approving foreign semiconductors, even when they are legally exportable.

Unclear Definition of Critical Infrastructure

One challenge is determining what China considers critical infrastructure. While military and government networks are obvious exclusions, the line becomes blurry with private companies.

Firms like Alibaba and Baidu provide cloud computing services to both private clients and state-linked organizations. This overlap complicates enforcement and may require careful monitoring rather than outright bans.

Nvidia vs China’s Domestic Chipmakers

Rivals Have Gained Ground

During Nvidia’s absence, Chinese chipmakers have made significant progress.

Huawei, working with Semiconductor Manufacturing International Corp., has improved its chip production despite US sanctions. Its latest Kirin 9030 processor, used in flagship smartphones, reflects these advances.

Cambricon, another major Chinese AI chip company, plans to more than triple its AI chip production in 2026 to fill the gap left by Nvidia.

Still the Gold Standard

Despite these gains, Nvidia’s AI accelerators remain the industry benchmark. Many of Nvidia’s older chips still outperform newer Chinese alternatives on a per-chip basis.

This performance gap is why Chinese tech firms continue to push for access to Nvidia hardware, even as domestic options improve.

Nvidia’s View From CES

High Demand, Limited Visibility

At the CES technology show in Las Vegas this week, Nvidia executives confirmed strong interest from Chinese customers for the H200.

However, they also said:

- Nvidia has not spoken directly to Beijing about approval

- The company does not know when China will officially greenlight sales

- Export license applications have already been submitted to the US government

- Final US approvals are being completed

Nvidia declined to comment further beyond these remarks.

Why This Matters Beyond Nvidia

Implications for the Global AI Race

If China approves H200 imports, it could accelerate the country’s AI development at a critical moment. Chinese firms are racing to close the gap with US leaders in generative AI, cloud computing, and advanced models.

Access to Nvidia’s hardware would:

- Speed up model training

- Improve performance

- Reduce reliance on less mature domestic chips

At the same time, restrictions ensure China does not gain access to Nvidia’s most advanced technology.

A Strategic Compromise

Neither a Full Ban Nor Open Access

China’s likely decision reflects a middle path:

- Allow commercial innovation to continue

- Protect sensitive sectors

- Maintain pressure to develop domestic alternatives

For Nvidia, this compromise still represents a major opportunity. Even limited access to China’s commercial sector could generate billions in revenue.

What Happens Next

All Eyes on Beijing

While the US has already approved exports, China has not publicly confirmed its stance. If approval comes this quarter, shipments could begin soon after.

If delayed or denied, Chinese firms may accelerate their shift toward domestic suppliers, further strengthening Nvidia’s rivals.

For now, both Nvidia and the global tech industry are waiting.

Final Thoughts

China’s potential approval of Nvidia’s H200 chips could mark a turning point in the ongoing technology standoff between the US and China. While the chips would come with strict limits, the move would reopen a vital market for Nvidia and give Chinese tech firms access to world-class AI hardware.

The decision highlights the complex balance between economic growth, national security, and technological independence. If approved, it would not end the chip war — but it would reshape the battlefield in a meaningful way.