China Prepares for Trade War 2.0: How the Nation is Strategizing for Trump’s Potential Tariff Tsunami

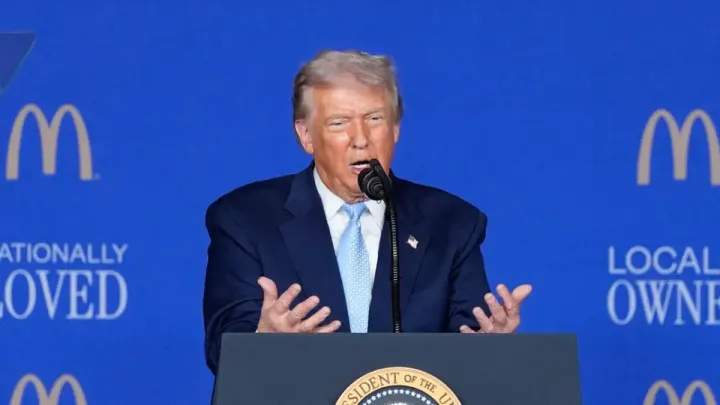

With Donald Trump set to return to the White House, China is bracing for a new wave of trade war tariffs. Despite economic challenges, Beijing is strategically preparing for a potentially dramatic trade conflict, using diversification and targeted retaliatory tactics.

China Gears Up for Trade War 2.0: How the World’s Second-Largest Economy Is Preparing for Trump's New Tariff Threats

As former President Donald Trump inches closer to reclaiming the White House in 2025, the looming specter of Trade War 2.0 hangs over the global economy. Trump has already made his intentions clear: if re-elected, he plans to escalate his tough trade stance on China, with potential tariffs soaring to 60% on Chinese goods. While China is undoubtedly facing a host of economic challenges, including a struggling real estate sector, massive debt concerns, and deflationary pressures, the nation is anything but unprepared for another battle with the U.S.

In fact, China’s leadership is more strategically equipped to handle Trump’s threats this time around. Beijing has spent the last few years diversifying its trade networks and distancing itself from over-reliance on the U.S. market, making the next trade war a much more nuanced and calculated contest.

China’s Trade Diversification: Cutting Dependence on the U.S.

When Trump launched his first trade war with China in 2018, the Chinese economy was riding high, with some experts even predicting it could soon eclipse the U.S. as the world's largest economy. But since then, China has been forced to confront a slew of challenges, from its declining property sector to rising debt burdens, and a slowing growth trajectory. These issues have inevitably strained China’s relations with global markets, including the U.S.

Yet, amid these difficulties, China’s leadership has been quietly shifting the country’s trade strategy. According to trade analysts, China has been actively reducing its dependency on U.S. exports and cultivating a more diversified portfolio of trade partners. As a result, while China’s exports to the United States dropped significantly—by 20% in 2023 to $427 billion—China’s share of global exports has actually increased, rising from 13% to 14% despite a decrease in sales to its once-dominant trading partner.

“China has been preparing for this day for a long time. The U.S. is much less important to its trade network now,” said Dexter Roberts, author of the Trade War newsletter and senior fellow at the Atlantic Council. As of last year, countries like Mexico have surpassed China in goods exported to the United States, a shift that illustrates China’s ongoing efforts to reduce its exposure to Trump’s protectionist policies.

China’s Retaliation Strategy: Targeted, Not Tit-for-Tat

While Trump’s first trade war with China was characterized by a tit-for-tat escalation of tariffs, Beijing’s response to Trade War 2.0 is likely to be more strategic, targeted, and asymmetric. Chinese officials are fully aware that direct retaliation in the form of large-scale tariffs or dumping U.S. Treasury bonds could backfire. As Andy Rothman, China strategist at Matthews Asia, explains, “The Chinese side typically doesn’t retaliate directly in that way. The market for U.S. Treasury bonds is too deep and liquid, and selling them could hurt Beijing’s own interests.”

Instead, China’s response will likely focus on more subtle tactics, including regulatory crackdowns on American companies operating within China. In recent months, Beijing has intensified its scrutiny of foreign businesses, with notable moves against U.S. companies. For example, in September, Chinese authorities launched an investigation into fashion giant PVH Corp. (owner of Calvin Klein and Tommy Hilfiger) for allegedly refusing to source cotton from Xinjiang—a region where China faces international scrutiny for human rights abuses. Such investigations may not only hurt U.S. firms but could also send a signal to other foreign companies about the consequences of crossing China’s red lines.

Additionally, Beijing has made its displeasure with U.S. firms clear by raiding offices of American consultancies, such as Bain & Company and Capvision, to send a message about the risks of operating in China under heightened political tensions. These types of retaliatory actions could escalate under Trump’s proposed tariff hikes.

The Impact of Trump’s 60% Tariff Proposal: How Will China React?

Trump has made bold promises to impose tariffs as high as 60% on Chinese imports, a move that economists warn could have catastrophic effects not only on China’s economy but on the U.S. consumer as well. A study from the Peterson Institute estimates that Trump’s tariff proposals could cost the average American household more than $2,600 annually, even as China’s economy could face a severe slowdown, with growth potentially halved under such a tariff regime.

However, China is no stranger to adversity. Even with its economic troubles, the country’s large domestic consumer market remains a vital asset. If exports to the U.S. take a hit, China may redirect its focus inward, relying more heavily on boosting domestic consumption. “The best response Beijing can make is to get its own house in order, restore confidence among Chinese entrepreneurs, and stimulate consumer confidence,” says Andy Rothman. This, he argues, would counterbalance the losses from reduced U.S. exports, helping to stabilize the Chinese economy.

China’s vast population—1.4 billion people—presents a potential lifeline for the country as it seeks to offset trade losses with the U.S. Over the past year, Chinese policymakers have begun targeting domestic reforms, including stimulus packages to support weak consumption, particularly in the face of a struggling housing market. In the third quarter of 2024, the Chinese economy grew by just 4.6%, far below expectations. However, the government is focusing on supporting the internal market, and any prolonged weakness in exports may prompt additional stimulus measures.

China’s Strategy for Trade War 2.0: Is Devaluation on the Table?

One tool often suggested for retaliation in a trade war is currency devaluation, which can make exports cheaper and offset tariff impacts. However, many analysts believe China is unlikely to pursue a significant devaluation of its currency, the yuan. Over the past few years, the yuan has already lost about 12% of its value against the U.S. dollar, but Chinese officials are wary of the potential consequences of a further devaluation.

A sudden devaluation could destabilize the already fragile Chinese financial markets and risk eroding confidence in the yuan as a global reserve currency. In recent months, the Chinese government has prioritized stabilizing the yuan and enhancing investor confidence, hoping to present China as an attractive destination for foreign investment. Moreover, there are broader geopolitical considerations at play: China wants the yuan to become a viable alternative to the U.S. dollar in global markets, a goal that could be undermined by reckless currency devaluation.

Preparing for the Long Haul: China’s Resilience in the Face of Economic Pressures

Despite the challenges facing its economy, China’s leadership is cautiously optimistic about its ability to weather the storm of a new trade conflict with the U.S. The combination of trade diversification, targeted retaliation, and domestic reforms should give Beijing the tools to mitigate the impacts of Trump’s proposed tariffs.

While the U.S. is no longer China’s largest trade partner, China’s growing economic ties with the rest of the world—particularly the Group of Seven (G7) countries—offer it a buffer against Trump’s punitive measures. In fact, just under 30% of China’s exports now go to G7 nations, a significant decrease from 48% in 2000. This shift reflects China’s success in diversifying its trade portfolio, allowing it to withstand external shocks like a new wave of U.S. tariffs.

In the coming months, as Trump prepares to take office, China’s leadership will be watching closely, ready to act as needed. Beijing’s response will not be hasty or purely reactive; instead, it will be calculated, leveraging its growing domestic market and strategic alliances to minimize the pain of another potential trade war.

Whether or not China can weather another round of Trump’s tariffs will depend on how well it manages its internal economic challenges, adapts to shifting global dynamics, and capitalizes on its strengths.