Cathie Wood’s Ark Innovation ETF Struggles While She Bets Big on AI Stocks

Cathie Wood Faces a Rocky Start to 2026

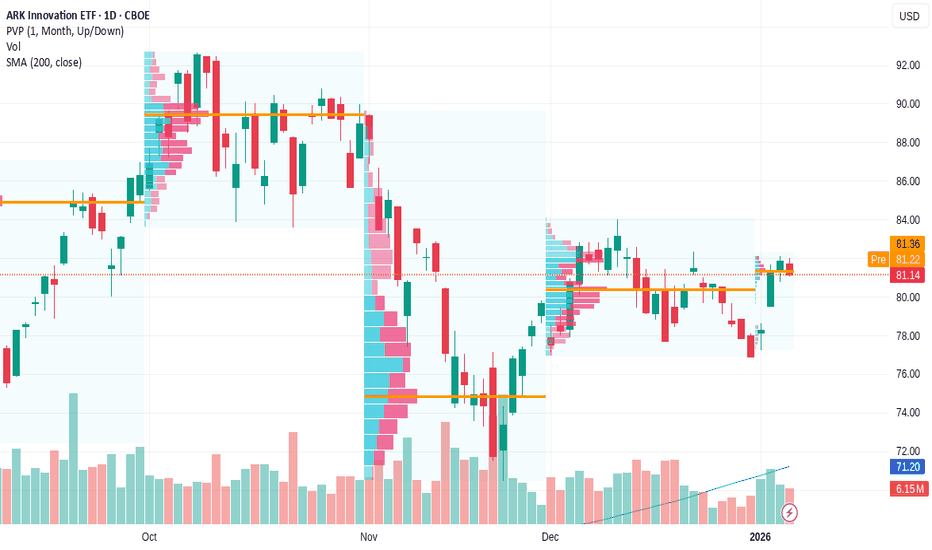

Cathie Wood, the founder of Ark Investment Management, has had a challenging start to the year. As of February 6, her flagship Ark Innovation ETF (ARKK) was down 9.58% year-to-date, while the S&P 500 gained 1.27%, reflecting mounting pressure on growth-focused tech stocks.

Known for actively managing her portfolio, Wood often times her tech investments to market trends. Last week, she made significant purchases in one of the largest tech companies, signaling her confidence in the sector despite recent market volatility.

Ark Innovation ETF’s Rollercoaster History

Wood gained fame after ARKK delivered a 153% return in 2020, cementing her reputation as a visionary investor in tech and innovation. In 2025, the ETF rose 35.49%, far surpassing the S&P 500’s 17.88% return.

However, her aggressive approach can lead to sharp losses. In 2022, ARKK fell over 60%, reflecting the risks associated with high-growth tech investments. Over the long term, these swings have impacted the ETF’s performance. As of February 6, ARKK’s five-year annualized return was -13.83%, compared to the S&P 500’s 13.92%, according to Morningstar.

Cathie Wood Rejects the “AI Bubble”

Wood continues to focus on emerging tech companies in AI, robotics, blockchain, and biomedical technology, believing they hold strong growth potential despite short-term volatility.

In a January 15 letter, she argued that the U.S. economy is poised for a powerful rebound in 2026:

"Despite sustained real GDP growth over the past three years, the economy has evolved into a coiled spring that could bounce back powerfully."

Wood dismissed talk of an AI bubble, calling it years away, and described the upcoming capital spending cycle as the most powerful in history. She emphasized that AI, robotics, energy storage, blockchain, and multiomics sequencing platforms are ready for mainstream adoption.

Recent Moves: Cathie Wood Bets on Alphabet

Wood recently made one of her largest investments in 2026 by purchasing 134,439 class C shares of Alphabet Inc. (GOOG), valued at roughly $43.4 million. These purchases occurred on February 2, 3, 5, and 6, surrounding Alphabet’s fourth-quarter earnings report.

Alphabet exceeded Wall Street expectations, reporting $2.82 earnings per share versus a $2.63 estimate and $113.83 billion in revenue, beating the forecast of $111.43 billion. Google Cloud revenue rose 48% year-over-year to $17.66 billion, driven by AI demand.

The company also projected capital spending of $175 billion to $185 billion in 2026, more than double its 2025 spend, aiming to meet growing customer demand and expand AI infrastructure.

Bank of America analysts reinforced their confidence, maintaining a buy rating and a $370 price target for Alphabet.

Top Holdings of Ark Innovation ETF

As of February 6, 2026, ARKK’s top ten holdings were:

- Tesla (TSLA) 11.30%

- CRISPR Therapeutics (CRSP) 5.66%

- Tempus AI (TEM) 5.33%

- Roku (ROKU) 5.04%

- Shopify (SHOP) 4.10%

- Advanced Micro Devices (AMD) 3.89%

- Coinbase Global (COIN) 3.70%

- Robinhood Markets (HOOD) 3.65%

- Beam Therapeutics (BEAM) 3.56%

- Twist Bioscience (TWST) 3.33%

Market Reaction and Investor Sentiment

Alphabet’s strong earnings report reinforced confidence in AI-driven growth, particularly in Google Cloud and AI services. Analysts noted that AI-powered products like zero-click search overviews and the Gemini app could serve as key revenue drivers.

Despite Wood’s optimism, not all investors are aligned. In the 12 months through February 5, ARKK experienced roughly $1.3 billion in net outflows, reflecting caution amid market volatility.

Cathie Wood’s Vision for 2026

Wood believes 2026 will be a transformative year for tech and AI. She views fluctuations in ARKK not as setbacks but as part of a long-term growth strategy, emphasizing that emerging technology investments often involve periods of volatility.

Her purchases in Alphabet and continued focus on AI, robotics, and blockchain reflect a bet on the next wave of innovation, even as her fund faces short-term losses and investor skepticism.

“What once was the cap in spending seems to have become a floor now that AI and other technologies are ready for prime time,” Wood said.

Final Thoughts

Cathie Wood’s Ark Innovation ETF remains one of the most closely watched tech-focused funds. While its recent performance has been volatile, her strategic bets on AI and tech giants like Alphabet demonstrate her long-term conviction in transformative technologies.

Investors considering ARKK should understand the high-risk, high-reward nature of the fund. Wood’s vision is clear: AI, robotics, and emerging tech will define growth in the coming years, and she is positioning her fund to capture that opportunity despite market turbulence.