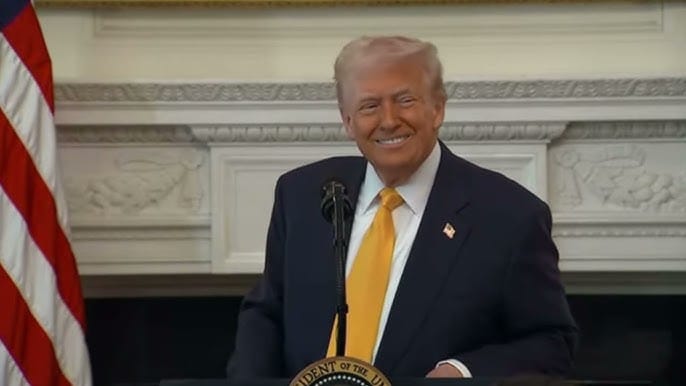

Bitcoin Hits $100,000 as Trump Nominates Pro-Crypto SEC Chair

Bitcoin hits $100,000 as Trump’s pro-crypto SEC pick Paul Atkins sparks rally.

Bitcoin made history on Wednesday, skyrocketing to an all-time high of $100,000, fueled by the announcement of President-elect Donald Trump's pick for the next chair of the Securities and Exchange Commission (SEC). The surge in cryptocurrency prices reflects growing optimism about the future of digital assets under a Trump administration that is increasingly seen as supportive of crypto policies.

The rally comes just weeks after the stunning gains following Trump’s victory in the presidential election. As Bitcoin continues its meteoric rise, the financial world is watching closely to see if the crypto boom will persist under new leadership and policy changes.

Bitcoin Surges to $100,000: A New Milestone

Bitcoin's climb to $100,000 marks a major milestone for the cryptocurrency, further cementing its status as a powerful financial asset. Just hours after Trump announced Paul Atkins, a former SEC commissioner and crypto advocate, as his pick to lead the SEC, Bitcoin hit the unprecedented $100,000 mark.

This latest surge comes on the heels of a $6,000 jump in Bitcoin’s price after Trump’s election win was projected on November 6. That one-day spike pushed Bitcoin past the $74,000 mark, and just one week later, it hit $90,000. Bitcoin’s performance this year has been nothing short of exceptional, up 130% so far, far outpacing the performance of traditional assets like the S&P 500, which has gained 28% during the same period.

A Shift in Trump’s Stance on Cryptocurrency

For those who have followed Trump’s past remarks on cryptocurrency, the current surge of crypto optimism is a surprising shift. As recently as a few years ago, Trump was a vocal skeptic of Bitcoin, calling it "highly volatile" and "not money." He even dismissed it as being "based on thin air." However, Trump’s rhetoric around cryptocurrency has shifted dramatically in the lead-up to the election.

In 2023, he made waves by headlining the largest crypto convention in Nashville, where he pledged to create a "strategic national bitcoin stockpile" for the U.S. government. He also announced plans to hold onto bitcoin seized from criminals, instead of auctioning it off, which is the current policy. His sudden pivot toward crypto seemed aimed at attracting younger male voters, a demographic that is more likely to own and trade cryptocurrencies.

Trump’s embrace of crypto deepened further when, in September, he launched his own cryptocurrency business called World Liberty Financial. He even made headlines by purchasing burgers at a Manhattan bar using Bitcoin, calling the moment "History in the making."

Trump’s SEC Pick: Paul Atkins and Crypto-Friendly Policies

The news that Paul Atkins would be nominated to lead the SEC has sent shockwaves through the crypto industry. A long-time supporter of the crypto space, Atkins is expected to take a less aggressive approach to regulating digital currencies than the current SEC chairman, Gary Gensler, who has been known for his stringent enforcement of cryptocurrency rules under the Biden administration.

Atkins’ tenure as a former SEC commissioner and his strong advocacy for crypto has positioned him as a favorable figure for the industry. Industry insiders are hopeful that under his leadership, the SEC will adopt a more hands-off approach, allowing cryptocurrencies to flourish without overbearing regulations.

A Pro-Crypto Administration on the Horizon

Trump’s nominations go beyond just the SEC. Along with Atkins, Trump has also tapped Howard Lutnick, CEO of Cantor Fitzgerald, as part of his administration’s crypto-friendly push. Lutnick, a well-known supporter of Tether, one of the world’s largest cryptocurrency assets, has been a vocal advocate for the industry.

Additionally, reports indicate that Trump is considering the creation of a White House role dedicated solely to overseeing cryptocurrency policy, signaling an even deeper commitment to pro-crypto initiatives.

This growing support for digital assets is likely to appeal to the many crypto investors who have backed Trump during the election cycle. Leading super PACs, which are political action committees, donated around $131 million to elect pro-crypto candidates to Congress. Trump's campaign also embraced crypto donations, raising millions from cryptocurrency supporters.

How Will Bitcoin Perform Under Trump’s Administration?

As Bitcoin hits new heights, there is increasing excitement about what the future holds for digital currencies under a more crypto-friendly administration. If Trump’s policies encourage innovation and loosen restrictions on crypto, the price of Bitcoin and other digital assets could continue to rise. The momentum seen since the election could propel Bitcoin toward even greater milestones, with some analysts predicting that Bitcoin could eventually reach $1 million per coin.

Anthony Pompliano, a well-known crypto advocate, was quick to capitalize on the bullish sentiment, saying, "If you like bitcoin at $100,000, you're going to love it at $1 million." With Trump and his administration moving to champion the cause of cryptocurrency, Pompliano’s prediction may not seem so far-fetched.

Federal Reserve’s View on Bitcoin: A Contrasting Opinion

Despite the excitement surrounding Bitcoin’s price surge, not all financial regulators share the same enthusiasm for cryptocurrencies. Federal Reserve Chairman Jerome Powell, for example, has expressed skepticism about Bitcoin, labeling it a "speculative asset." He believes that while Bitcoin shares some characteristics with gold, it is not a true competitor to the U.S. dollar.

According to Powell, Bitcoin functions more like a store of value, akin to gold, than a widely used currency for everyday transactions. In fact, Powell has publicly stated that he is not allowed to own cryptocurrencies due to his role as head of the Federal Reserve.

The Road Ahead for Cryptocurrency

As Bitcoin continues to soar, it is clear that the cryptocurrency landscape is evolving, with President-elect Trump and his administration poised to play a significant role in its future. The nomination of Paul Atkins to lead the SEC is just the beginning of what could be a sea change for the regulatory environment surrounding digital currencies.

With Trump’s growing embrace of cryptocurrency, coupled with the backing of the industry, the future of Bitcoin and other digital assets seems brighter than ever. However, challenges remain, particularly with traditional regulators like the Federal Reserve, who continue to view Bitcoin through a more cautious lens.

For now, cryptocurrency enthusiasts are celebrating the $100,000 milestone and anticipating more positive moves for digital currencies under Trump’s pro-crypto policies.