3 Ways a Trump Administration Could Revolutionize the Future of Crypto

Explore how the Trump administration could reshape the future of crypto with pro-business policies, a strategic Bitcoin reserve, and a revamped mining industry. Could Bitcoin hit $100K under Trump

3 Ways the Trump Administration Could Shape the Future of Crypto

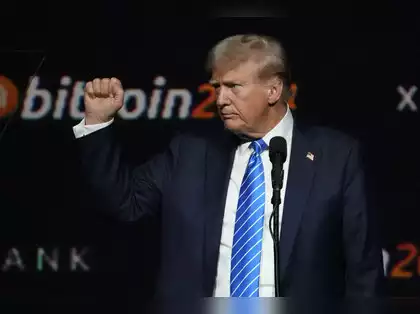

Since Donald Trump's presidential victory, the price of Bitcoin (BTC) has surged to new heights, reaching nearly $90,000—a 30% increase. Some investors are even predicting that Bitcoin could break the $100,000 barrier before Trump is officially inaugurated. As the market reacts to this optimistic outlook, many are wondering what these changes could mean for the future of cryptocurrency under Trump's leadership.

While it's clear that the Trump administration is seen as a potential boon for crypto, what exactly does that entail? Here's a look at three key ways Trump could impact the world of cryptocurrency.

1. A Pro-Business Environment for Crypto

During his campaign, Trump promised to make the U.S. the "crypto capital of the world," signaling his support for creating a more favorable environment for crypto businesses and investors. A major part of this initiative would be overhauling the existing regulatory framework, which is currently dominated by the U.S. Securities and Exchange Commission (SEC).

The SEC has often been a roadblock for crypto companies, as it has imposed regulations that some argue make it difficult for businesses to thrive in the U.S. Companies like Coinbase and Ripple Labs have had their fair share of battles with the SEC, leading to some considering relocating to more crypto-friendly countries. Under a Trump administration, however, there’s hope that the SEC will take a more hands-off approach, especially with Trump's vow to replace SEC Chairman Gary Gensler—a figure often seen as hostile toward crypto—with someone more crypto-friendly.

Additionally, we could see Congress passing favorable new crypto legislation in 2025, with bipartisan support, designed to unlock the potential of this emerging sector.

2. Creation of a Strategic Bitcoin Reserve

One of the most innovative ideas being floated by the Trump administration is the creation of a strategic Bitcoin reserve. The idea is for the U.S. government to purchase 1 million bitcoins over the next five years, thereby accumulating 5% of all Bitcoin in circulation. This would position the U.S. as a leading global force in cryptocurrency, akin to the way oil is stored in the Strategic Petroleum Reserve.

What makes this move particularly intriguing is how the reserve could be used. The U.S. might tap into this Bitcoin stockpile during times of economic instability, using it to stabilize the economy or potentially reduce the national debt. For example, if Bitcoin's value skyrockets—as some experts, like Cathie Wood of Ark Invest, predict—it could become a powerful tool in reducing the country’s $35 trillion debt. With Bitcoin’s price potentially reaching $1 million per coin, the U.S. could turn its Bitcoin holdings into a trillion-dollar asset.

This idea isn't just theoretical. The Bitcoin Act of 2024, introduced by Senator Cynthia Lummis during Trump’s campaign, sets the groundwork for such a move, signaling the likelihood of a Bitcoin reserve under Trump.

3. Revitalizing the U.S. Bitcoin Mining Industry

Another area where Trump is expected to make an impact is the U.S. Bitcoin mining industry. On the campaign trail, Trump expressed interest in making sure that all Bitcoin mined in the U.S. is produced domestically. In his view, Bitcoin mining is not just a way to produce digital assets but also an opportunity to create jobs, particularly in rural communities where cheap energy is available.

Trump has framed Bitcoin mining as a form of industrial growth, similar to coal mining, that can stimulate local economies. This approach may lead to a new national strategy for Bitcoin mining, integrating it into the broader energy policy. This could involve enhancing the U.S. energy grid and potentially relaxing some of the environmental regulations surrounding Bitcoin mining, making it more economically viable.

Such changes could lead to lower production costs for Bitcoin miners, which would in turn make mining more profitable. As a result, we might see a surge in U.S.-based Bitcoin mining operations, potentially driving up both the domestic Bitcoin supply and the value of Bitcoin itself. Investors will be watching closely to see if these policy changes create a boom for Bitcoin mining stocks in 2025.

How Likely Are These Crypto-Friendly Policies Under Trump?

Of course, it’s important to temper enthusiasm with a dose of realism. Campaign promises don’t always translate into policy action, and some of Trump’s more ambitious ideas, such as the creation of a strategic Bitcoin reserve, may not come to fruition. Additionally, the role that crypto advocates like Elon Musk may play in a Trump administration remains unclear.

However, the general shift toward crypto-friendly policies seems likely, especially as more lawmakers and key figures express support for the industry. Investors who believe in a positive future for crypto are already positioning themselves for what’s being called the “Trump trade”—the idea that Bitcoin and other cryptocurrencies will thrive under a pro-business administration.

Conclusion

The Trump administration’s approach to cryptocurrency could have a profound impact on the market. From creating a pro-business environment that encourages investment and innovation to potentially establishing a strategic Bitcoin reserve and revitalizing the Bitcoin mining industry, these moves could send Bitcoin and other cryptocurrencies soaring.

While it remains to be seen how much of this agenda will be realized, one thing is clear: if the Trump administration follows through on these policies, the future of crypto could look very bright indeed.