$2 Billion Shake-Up: Renesas Plans to Sell Key Chip Unit Powering AI and 5G — Here’s Who Wants It

Renesas May Sell Its Timing Chip Division for $2 Billion

Japanese chipmaker Renesas Electronics is considering a major move that could reshape its business strategy and shake up the global semiconductor market. The company is reportedly exploring the sale of its timing chip division, a unit that could fetch up to $2 billion.

The sale is still in its early stages, but big-name buyers are already showing interest. If the deal goes through, it could be one of the biggest moves in the semiconductor space this year.

What Does Renesas Want to Sell?

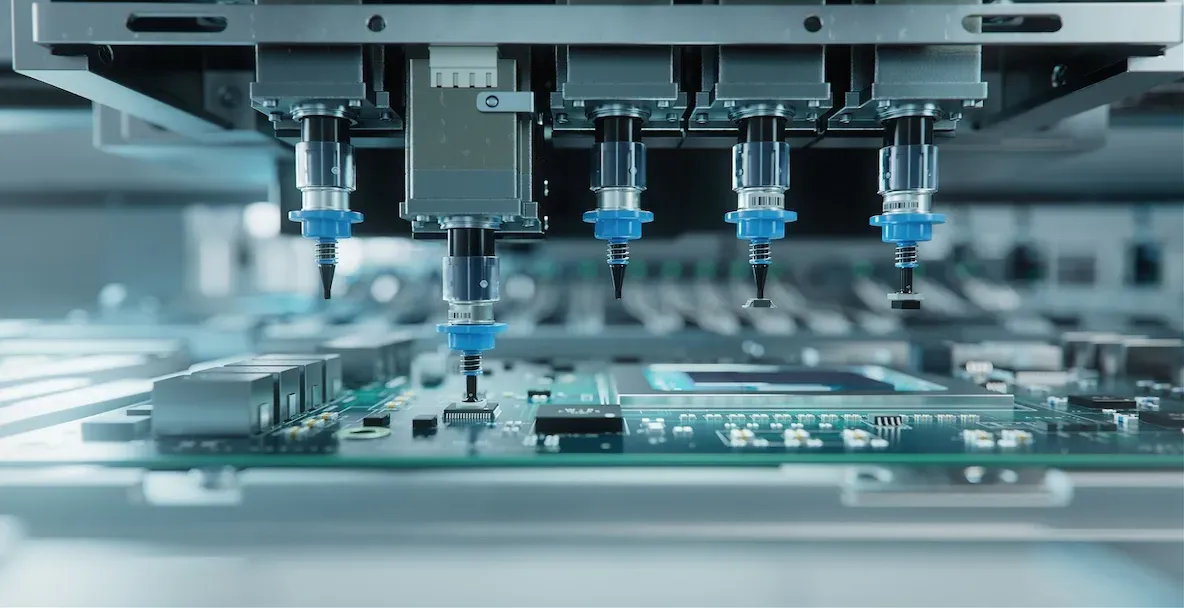

Renesas is looking to offload its timing division, a specialized part of the business that makes integrated circuits (ICs) responsible for clock, timing, and synchronization in high-speed electronics.

These chips act like a “heartbeat” for digital systems, ensuring that data flows smoothly and devices stay in sync. They’re essential in environments where massive amounts of data move quickly, such as:

- Data centers

- 5G mobile networks

- Telecom infrastructure

- Networking equipment

Without precise timing chips, servers and other connected devices can’t communicate properly. It’s a small piece of the puzzle, but one with a huge impact on performance and stability.

Why Is Renesas Selling This Business?

The possible sale is part of a larger strategy shift. Renesas, known as one of the largest suppliers of microcontrollers in the world, is aiming to focus more on automotive and industrial chips — areas where it already has a strong presence.

Here’s why selling the timing division makes sense for Renesas:

- Raise capital: A $2 billion sale would bring in funds that can be reinvested in core areas like automotive, which is rapidly evolving with electric and autonomous vehicles.

- Sharpen focus: Instead of spreading resources thin across too many sectors, Renesas can double down on what it does best.

- Stay competitive: The chip industry is moving fast. Shedding non-core assets allows companies to adapt more quickly to new trends.

Renesas has already made several acquisitions in recent years to strengthen its portfolio in analog and power management chips. Selling the timing unit would continue this reshaping of the business.

Who Might Buy It?

Although no official buyers have been named, industry insiders suggest that Texas Instruments and Infineon Technologies could be among the companies exploring a purchase.

Here’s why these companies might be interested:

- Texas Instruments: A dominant player in analog chips and embedded processors, TI could integrate the timing unit into its existing product lines, especially for communications and data infrastructure.

- Infineon Technologies: Based in Germany, Infineon is heavily involved in power systems and automotive chips. Adding a timing unit would deepen its reach into the growing telecom and data center markets.

With AI, cloud computing, and 5G accelerating demand for high-performance, synchronized systems, this kind of technology is more valuable than ever.

Why Timing Chips Matter More Than You Think

Timing and clock ICs are the unsung heroes of modern electronics.

Here’s what they do:

- Synchronize systems: Whether it’s two servers talking to each other or your phone connecting to a 5G tower, timing chips make sure everything happens at exactly the right moment.

- Prevent errors: In fast, high-data environments, even a small misstep in timing can cause major data issues. These chips keep things running smoothly.

- Support complex tech: AI, machine learning, cloud services — all of these require flawless communication between devices, made possible by precision timing.

As technology advances, the demand for ultra-accurate, high-speed synchronization will only grow. That makes this division a hot commodity for companies looking to expand in high-growth tech sectors.

What This Means for the Chip Industry

If Renesas does sell its timing unit, it would be part of a broader trend in the semiconductor world — portfolio optimization.

Chip companies are under pressure to:

- Innovate faster

- Specialize in high-demand areas

- Streamline operations to compete globally

This often means selling off non-core divisions to raise cash and refocus. Other companies have done the same in recent years, and it’s a signal of how competitive the chip space has become.

The Bigger Picture: AI, 5G, and the Future

The timing of this potential deal couldn’t be more relevant. Across industries, there’s exploding demand for the very technologies these chips support.

- Data centers are expanding rapidly to handle AI workloads and massive online platforms.

- 5G networks are still being built out, especially in emerging markets.

- Cloud gaming, streaming, and smart devices need real-time synchronization to work without lag.

All of this creates a booming market for clock and timing chips. Whoever acquires the Renesas unit would instantly gain a strong position in this high-demand sector.

What Happens Next?

The sale is still under discussion, and no deal has been finalized. Renesas is working with financial advisors to assess interest, and potential buyers are being quietly approached.

In the coming months, keep an eye out for:

- Official announcements from Renesas

- Bidding activity from major chipmakers

- Any shift in stock prices or industry moves based on the sale

Final Thoughts

Renesas exploring the sale of its timing chip division is a big move — and one that could shake up the balance in the global chip market.

On one hand, it gives Renesas the chance to refocus and invest more heavily in its strengths. On the other, it opens the door for another tech giant to gain a foothold in one of the fastest-growing areas of modern electronics.

With AI, 5G, and high-speed networking all accelerating, the timing couldn’t be better — or more critical.